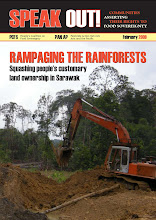

Open Email to Sarawak BN ADUNs and MPs

Unfortunately I am not able to send this open email to most of the Sarawak BN ADUNs as their email addresses could not be found on the Sarawak State Assembly site. I am not sure why as in this modern time, all ADUNS must be able to communicate with and accessible by email. I hope they are not living in the Sarawak jungles like our fellow Penans.

I have not been able to send this open email to some Sarawak BN MPs as their email addresses are also not available on the Malaysian Parliament web site. I am not sure why, either they do not wish people to contact them or they do not know how to use the Internet.

Dear Sarawak BN ADUNs and MPs, do you all serve the people of Sarawak or yourself, your families, relatives and your friends ?

When you came into office, you all swore on the Bible or the Koran that you would serve the people of Sarawak, although there was no mention that you should serve yourself, your families, your relatives and your friends. But common sense will tell you all that Corruption is a crime in Malaysia. Yet Corruption is so rampant in Sarawak, especially among the BN politicians.

However, since you came into office, it has been shown that many of you serve only yourselves, your families, your relatives and your friends, and have neglected the Sarawak people at large. Taib's "Politics of Development" has only benefited a handful of people, especially those related to the BN politicians and State ministers. This is not lies, but facts.

Many reports have been published in the media and many other sources, locally in Malaysia and overseas, including the Registrar of Companies, Bursa Malaysia, web sites of companies such as CMs Bhd., the records on Land & Survey, etc etc. Kyoto News and Tribune Pontianak, that show many of you, your families, your relatives and your friends and those close to you, own lands given by the State Government, shares in various companies owning lands given by Sarawak Givernemnt, oil palm plantations and timber concessions and timber related industries, and contracts awarded by the state government to various parties related to the ministers or BN politicians without any tender and bids being called, in contradiction to the Government's tendering and procurement procedures.

Although I believe that some of you are not involved in any of these and do not have any interests at all in these instances of conflict of interests situation, however, you choose to keep quiet and have not voiced out against what is definitely wrong practised by the state government led by CM.

I wonder whether you all have any conscience at all and how you can tolerate this sort of corruption and cronyism going on in the state. You choose to turn a blind eye to what has been happening in the last 25 years on the actions by the state government that things are getting from bad to worst.

By not voicing out against what is clearly wrongful and illegal acts by the state government and its ministers, you are allowing those ADUNs and MPs committing the wrongs which they swore not to do and you are not serving the people of Sarawak protecting their interests and the interests of their next generations.

I give below some of the information which I know you already knew long time ago. Maybe each time you pretend that you do not know or choose not to believe them.

These are not stories made up by anyone, not lies told by local and overseas media or persons, but HARD facts.

* How did our CM justify the fact that his immediate families and relatives managed to purchase so much shares in CMS ? Did our CM inherit a lot of riches from his parents or someone else ? We all know that he was brought up by a poor family in Sarawak and did not have much money at all.

Name of Shareholder No. of Ordinary Shares Held % of Issued Capital

Majaharta Sdn Bhd 44,925,102 13.64

Lejla Taib 37,000,000 11.23

Sulaiman Taib 29,465,085 8.94

Mahmud Taib 23,400,085 7.10

Hanifah Hajar Taib 705,000 0.21

Records also show that Hanifah Hajar Taib, Ahmad Alwee Alsree and Jamilah Hamidah Taib own shares in Majaharta Sdn Bhd.

* Contracts were awarded by the state government to CMS (substantially owned and controlled by Taib's family) for the construction of the new DUN building. CMS then subcontracted to Bina Puri (a subsidiary of a Malaysian listed company) for a sum which is RM75 million less than the awarded price. Records also show that contracts worth more than RM1 billion were also awarded to CMS for road maintenance in Sarawak, and another worth more than RM 1 billion for construction of 500 bridges was awarded to Titanium Management Berhad who is owned by Taib's son and his friend, Chris. Apparently the contract sum has been exceeded before all the bridges have been built.

* Many hundreds of thousands of state (and maybe NCR) lands have been given away by the state to the CM's family members, relatives, friends and companies known to be controlled by the CM's family or relatives and friends.cronies at very low prices and they sold some to the real plantation companies at 20 to 30 times the prices which they pay the state government. In many cases, they sell the shares in the companies which they own such that they are not subject to income taxes in Malaysia.

*

One of the local NGO officials involved, Peter John Jaban, in a statement today, dared Jabu to reveal the real reason behind his refusal to allow the state government agency to meet up with the NGO officials. Jaban said the deputy chief minister's cancellation of the briefing at the last minute, when the officials were already in Salcra headquarters, had nothing to do with him contesting as a candidate against Jabu.

"When Jabu refused to allow officials of Salcra to meet us, he should explain the real reasons behind his decision," Jaban said.

He believed it had more to do with what he (Jaban) tried to expose during the election campaign period - the involvement of a plantation company, Durafarm Sdn Bhd, in a land tussle with NCR landowners in Betong.

kampung chang sungai gepai encroachment 300307 excavator One of the directors and major shareholders in the company is Robert Lawson Chuat, Bukit Sabah state assemblyperson and Jabu's nephew.

Durafarm, which is controlled by a Sibu-based timber and plantation company, has more than 6,000 hectares plantation land allocated to it by the state government.

Jaban said he had documentary evidence to prove this fact and also to show that two other companies - Zainoon Shipping Sdn Bhd and Biogift Sdn Bhd of which Jabu's son Gerald Rentap is director and major shareholder - have businesses dealing in transportation and fertilisers linked to Salcra.

WTK group also owns two oil-mills with a total production capacity of 90 tonne of FFB per hour. To cope with the increasing production of FFB within our group as well as to provide services to other small holders, a new 60-tonne palm oil mill will be operational by the 1st quarter of Year 2004. At present, the annual total production of FFB is 400,000 tonne. In coming years, our production is expected to be better with the larger matured acreage. WTK's palm oil operations have contributed substantial cash flow to the group over the years. To synergise and consistent with the group expansion programme and down stream development for higher-value addition of palm oil products, WTK group is planning to move into palm oil refinery in the near future. Our group's determination and intense focus in monitoring cost efficiency and increase productivity to ensure that all operations are run with reduced production cost and improved profit contribution. Our group's is now beginning to reap the fruits of its aggressive ventures into oil-palm sector over the past few years.

To enquire, please contact:

Mr Neil Wong Hou Lianq

Chief Operating Officer - Agribusiness (Oil Palm)

Ms Patricia Lee

BHB Sdn Bhd (26303-V)

Utahol Sdn Bhd (323032-T)

Oxford Glory Sdn Bhd (T.370774-W)

Southwind Plantation Sdn Bhd (T197239-W)

Tajang Laing Holdings Sdn Bhd (47605-V)

Medan Mestika Sdn Bhd (466200-U)

Imbok Enterprise Sdn Bhd (151435-P)

Ms Helen Loh

Suajaya Mahir Crop Sdn Bhd (426032-K)

Durafarm Sdn Bhd (461165-M)

Harvard Master Sdn. Bhd. (397883-D)

WTK Oil Mill Sdn Bhd (274278-P)

* See attached list of lands given away by the state government to various people

* No action has been taken on various corruption reports lodged with ACA for corruptions against Sarawak Minister/s :

Taib implicated in Indon timber scam

Aug 23, 08 3:55pm

"The good name of the chief minister and that of the government-owned company have been marred by the report," Sarawak PKR chief Dominique Ng told Malaysiakini.

Ng said PKR will lodge a report with the Anti Corruption Agency on the matter. According to him,the Tribun Pontianak report was serious enough towarrant immediate investigation by the authorities here, especially since Indonesia and Malaysia have an existing agreement prohibiting the illegal export of logs.

"Let the relevant authorities carry out an immediate and thorough investigation," said Ng, who is also assembly person for Padungan.

The front-page news report was accompanied by a chart detailing how logs were being transported illegally from the forests in Ketapang and how they were being shipped out of West Kalimantan to two places. The names of some middlemen purportedly involved in the scam were also mentioned.

According to the report, several individuals were charged in an Indonesian court for complicity in illegal timber trade, including the forest controller for the area, a M Darwis. The report said Darwis admitted to receiving bribe money from the individuals in exchange for allowing the logs to be illegally taken out of Ketapang.

The forest controller told the court the bribe money amounted to between Rp 10 million and Rp 40 million for each shipment of between 800 and 1,000 cubic metres of timber.About 30 shipments of illegal logs worth some Rp2.16 trillion(about RM750,000) were being taken out either by land or sea across to the East Malaysian state every month.

NGOs go undercover

An Indonesian-based NGO together with a UK-based NGO investigating the illegal timber trade in Indonesia had gone undercover to Sarawak, where they traced the eventual destination of the logs.

The name of Harwood Sdn Bhd was implicated, although Tribun Pontianak erroneously reported the firm was owned by 'the governor of Sarawak' Abdul Taib Mahmud.The news report also highlighted a dialogue the European Commission had in Kuching with various stake-holders and NGOs on issues of the legality of the timber being exported to Europe.

The legality issue is tied to, among other things, the sources of the timber and respect for the rights of indigenous groups living on the land from which the timber is extracted.Malaysiakini understands some of the logs end up being processed by local industries, which would otherwise face a shortage because of an increase in manufacturing activities and also because Sarawak still allowed the export of timber. Up to 40 percent of the total annual production of round logs is exportable.

Timber is one of Sarawak's main earners accounting for several billions of ringgits in export revenue each year.

Taib family's CMS to benefit from dam

Sep 30, 08 11:30am

MCPX

''Is it Sarawak Energy (Berhad) or will it be passed on directly to the state government and hence the taxpayer,'' asked one Sarawak-based activist, who declined to be identified.

In the case of Bakun, the mega-dam in central Sarawak which is still under construction, compensation to indigenous people and resettlement cost the Sarawak and federal governments over RM876 million.

But there are still Bakun residents who have not received compensation even though they left the Bakun area 10 years ago,'' noted the auditor-general in his 2007 annual report.

Sarawak Energy Berhad (SEB), which is 65 percent owned by the Sarawak state government, will fund the Murum dam. It was reported in June that SEB would issue bonds to finance the project.

SEB has been in negotiations with infrastructure firm Cahaya Mata Sarawak (CMS) and the multinational Rio Tinto Alcan to supply 900-1,200MW of electricity to power a huge smelter. A power purchase agreement was supposed to have been signed by Aug 31, and there has been no news since.

Both CMS and Rio Tinto are in a consortium, the Sarawak Aluminium Company (Salco), to build the US$2 billion aluminium smelter with an initial annual capacity of 550,000 tonnes, which could later be expanded to 1.5 million tonnes. The smelter is located in the Similajau area of Sarawak, not far from the proposed Murum and Bakun dams.

Rio Tinto Alcan, which has a 60 percent stake in Salco, owns bauxite mines, alumina refineries and aluminium smelters around the world.

CMS, a listed infrastructure firm controlled by Sarawak Chief Minister Taib Mahmud's family, is a major producer and supplier of steel, cement and other construction materials in the state. Taib has been chief minister of Sarawak for more than 25 years.

According to the firm's 2007 annual report, the substantial shareholders of CMS are the chief minister's daughters, Jamilah Hamidah and Hanifah Hajar, son-in-law Syed Ahmad Alwee Alsree, and family concern Majaharta Sdn Bhd, each with a 14 percent stake.

Taib's wife Laila has an 11 percent stake while sons, Sulaiman Abdul Rahman and Mahmud Abu Bekir, own 9 percent each.

Taib's brother-in-law, Aziz Husain, on the other hand, happens to be managing director of SEB.

Why the need of so many dams?

Sarawak plans to lure such energy-hungry industries by providing an abundant supply of cheap electricity within the 320-km long Sarawak Corridor of Renewable Energy (Score), an economic development region, managed by the state, where abundant power would be supplied to energy-intensive private industries.

Score, launched by Prime Minister Abdullah Ahmad Badawi in February 2008, aims to tap into the state's 20,000MW hydropower potential by building even more dams in the longer term.

Sarawak's current installed capacity is just 980MW, adequate for its current needs of about 750MW, but it aims to expand its hydro capacity to 7,000MW or more over the next decade by building a string of 12 dams along the various rivers in the state.

hydropower projects in sarawak 2008 2020 murum

While smelters could create jobs and contribute to GDP, the funding for the dams required to supply cheap electricity will have to be raised by the state or borrowed from public pension funds (as in the case of Bakun).

''Will that justify building Murum at a probable estimated cost of RM3 billion, with likely cost overruns to RM5 billion?'' asked a Sarawak-based academic, who declined to be identified.

In the case of Bakun, ''cost over-runs of RM708 million were approved by the Finance Ministry even though the contract was for a fixed lump sum with all risks to be borne by the main contractor (a consortium of private Malaysian companies and China interests),'' chided the auditor-general in his report.

Sarawak Hidro, the Bakun dam developer, has outstanding borrowings (as at end-2007) of RM3.4 billion. It had received RM3 billion from a state-managed workers' pension fund, the Employees' Provident Fund (EPF) in 2007, and RM400 million from a state-owned pension trust fund in 2002.

The EPF loan is guaranteed by the federal government. The federal government had also allocated RM1.8 billion for the project between 1997 and 2004. Sarawak Hidro has already spent RM4 billion on the project.

Natives: Better bomb us now

So is Murum really necessary?

''For energy needs in Sarawak, we don't need the Murum, because Bakun is more than enough to supply the state's needs,'' says Raymond Abin of the Borneo Resource Institute (Brimas). ''Of course, (much of) this will not go to the really rural areas but will supply industry's needs."

The impression among many sceptics is that these are all self-serving projects," said another senior academic in a Sarawak-based university, carefully weighing his words while requesting anonymity.

All these funds are not helping the most affected communities like the Penan.

''This is not development for the Penan. This is not assisting the Penan,'' says Weng, a Penan whose home will be submerged. ''This is killing the Penan. As our old headman said before, better bomb us now than 'kill' us slowly!''

Yesterday: Sarawak begins work on new RM3 bil dam

Taib Mahmud & Family's Dirty Smelter Deals

Wednesday, May 7, 2008

Sarawak will soon have what reports say could be one of the world's largest aluminium smelters:

Global miner Rio Tinto Ltd. and Malaysian conglomerate Cahya Mata Sarawak signed a pact Tuesday to jointly build an aluminum smelter in Malaysia's eastern state of Sarawak.

Production from the smelting plant on Borneo island will begin in the fourth quarter of 2010 with an initial annual output of 550,000 metric tons, rising to 1.5 million tons over time, the companies said in a statement.

Under the agreement, the companies will undertake a feasibility study to be completed in 18 months, the statement said.

Rio will hold a 60 percent stake in the venture to be known as Sarawak Aluminium Company. The remaining 40 percent will be owned by Cahya Mata, in which the family of Sarawak Chief Minister Abdul Taib Mahmud is a key shareholder.

The smelter will be powered by the 2,400-megawatt Bakun hydroelectric dam due to be completed by 2010.

The company says the plant will create thousands of jobs and boost the Malaysian economy.

Sure, although I got a feeling that many of those jobs will be taken up by migrant workers.

But that's not what worries me most.

In case you didn't know, Rio Tinto is not exactly the world's most popular company, and aluminium smelting is not exactly an activity that is benign to human health and the environment.

In fact, aluminium smelting consumes humongous amounts of energy:

Besides using one-fifth of the Queensland state's electricity, around the world, Rio Tinto smelters use one-sixth of New Zealand's power, a quarter of Tasmania's and a tenth of Wales's

Loads of power, large tracts of land, and cheap labour — Sarawak is just the sort of place that Rio Tinto likes.

There's also one more fact that makes it and places like the Middle East attractive locations for aluminium smelting:

Why so? It's a no-brainer. As the company's head of climate change told me when I asked about the new geography of aluminium smelting: "Abu Dhabi is outside the Kyoto protocol."

Malaysia is a signatory, but "as a developing country, Malaysia has no quantitative commitments under the Kyoto Protocol at present", according to the Centre for Environment, Technology and Development Malaysia.

Wonderful, eh?

That's not all. Sarawak chief minister Taib Mahmud says there's room for two smelters.

People of Sarawak, enjoy your "development", Barisan Nasional-style.

BUT MAYBE there's a way out of this yet.

Is Sarawak a signatory of the Islam Hadhari convention?

Because if it is, Sarawakians can invoke Principle #9, which is "safeguarding the environment". MERDEKA!

Comment:

Environ 15 August 2007 @ 3:17 pm

Rio Tinto evades questions on Bougainville at AGM

Friday 5th May 2006

Rio Tinto evades questions on Panguna at AGM (and affirms riverine waste dumping as 'best practise' at the Freeport mine)

Rio Tinto directors evaded questions over whether they would take responsibility for the legacy of environmental problems at the Panguna mine on Bougainville Island, and failed to make any clear commitments that they would engage the Indigenous traditional landowners before continuing discussions over resumption of the operations. While they said they had "no plans' to reopen the mine, they did admit that discussion where taking place amongst some stakeholders.

The issue is highly charged, given the tens of thousands of lives lost when the environmental problems caused by riverine waste dumping and the exclusion of traditional landowners concerns shut down the mine and lead to a civil war. There remains significant sentiments on the island that the project should never be reopened, and legitimate concerns that failing to respond to community sensitivities could be a receipe for disaster.

Moses Havini, the International representative for Bougainville for the last fifteen years who attended the A.G.M in Melbourne sought commitments for independent environmental studies and acknowledgement of the rights of traditional owners before discussions on the mine could continue, and sought commitments that Rio Tinto would halt any talks until traditional landowners impacted by the mine would be included as equal participants.

Mr. Havini is concerned that the essential commitments and necessary discussions with local people are not taking place.

"Mining companies must radically change their terms of agreement with traditional landowners in the Pacific region. Firstly, further independent environmental impact studies must be carried out before any decisions are made regarding mining in Panguna, or elsewhere. Secondly, the traditional landowners should be given a fair share of any mining venture, and their right to free, prior and informed consent for any developments respected. Thirdly, mining companies in the Pacific must not pump their tailings any more into the river systems or into the seas. Fourthly, the Panguna Landowners Association are still to be fully compensated including arrears by Bougainville Copper Limited, and Fifthly, RTZ must fully commit itself to a full environmental cleanup of toxic materials and chemicals strewn from the Panguna Copper mine to the Port of Loloho" Mr. Havini said.

Rio Tinto said that they were continuing discussions with the other shareholders in the mine and the provincial and P.N.G. national government, but made no commitment that the traditional landowners would be included in these discussions.

With customary landownership by traditional indigenous owners the primary form of landholding across Papua New Guinea and the recent approval of a Constitution for Bougainville that firmly places the ownership of land and resources with the people, Rio's top down approach, and the question of ownership of the lease itself is unresolved and set to inflame issues.

"One would have hoped that previous experiences would have taught the company that customary indigenous landowners whose lands will be impacted need to be included from day one of any discussions, and their rights to exercise free, prior informed consent over projects on their land acknowledged." stated Techa Beaumont of the Mineral Policy Institute. " Rio Tinto has done as much in Australia at mine such as Jabiluka, so why will they not do the same in our neighbouring countries? In the context of what people of Bougainville have suffered as a result of Rio Tinto's former operations, any other approach shows a reckless disregard for the suffering and loss of life that has occurred."

Rio Tinto was also under fire for its involvement in the Freeport mine.

"Freeport is contributing to the suffering in West Papua because it funds the Indonesian government and military", West Papuan refugee Herman Wanggai told the meeting.

"You can't separate what the mine is doing from the political situation in West Papua. It is directly linked to the human rights problems."

Claims about the environmental impact of tailings released into the river system, and ongoing breaches of environmental laws were also raised following the release of a report into the mine this week by Indonesian environmental NGO WALHI.

Rio Tinto defended the contraversial practice, which BHP Billiton ruled out ever using again after admitting the environmental disaster it caused at the Ok Tedi mine. Chairman Paul Skinner continued to defend its use at Freeport, saying that the company believed its use was best practice for the operation. He did concede however that they would not consider utilizing it again in any proposal to reopen the Panguna operation.

"Rio's defense of riverine tailings disposal at Freeport as an example of 'best practice' is disturbing," Minerals Policy Institute Executive Director Techa Beaumont said.

Skinner also refused to answer questions on when the mine would stop breaching Indonesia's environmental regulations. The breaches led to the Indonesian environment ministry calling on the company to comply with Indonesian laws earlier this year. Mr Witoelar was reported by Reuters news service in April as saying "If they don't do it (points necessary to comply) then we would give a warning. If they still don't do it then we will bring them to court.

For more information, please contact:

Techa Beaumont, Executive Director, Mineral Policy Institute 0409 318 406

Moses Havini, International Representative of the Bougainville Autonomous Government: 0409226428

Monday September 1, 2008

A-G's report: Costly delay on Bakun dam project

KUALA LUMPUR: Finance Ministry Inc and Sarawak Hidro Sdn Bhd (SHSB) were reminded to ensure that contractors complete work within time for the Bakun project to avoid further delay and cost increases, as RM3.91bil had been spent as of last year for the construction of the dam.

The initial cost of the dam was RM4.5bil, but SHSB had already borrowed RM5.2bil from 2002 to 2007 for the project.

The Auditor-General's Report for 2007 said the main dam, scheduled for completion last September, was given an extension till June 2010 because of 16 work order modifications issued by SHSB.

The Finance Ministry also approved an additional RM708mil for the Malaysia-China Hydro Joint Venture (MCHJV), a consortium of seven companies formed to build the main dam and other related work.

It said the failure of MCHJV to complete work on time affected progress of mechanical-electro work, resulting in the contractor, Alstom Power Asia Pacific Sdn Bhd, seeking compensation of RM161.34mil, while BEM1-C Contract Consortium, another contractor for the mechanical-electro work, asked for RM349.46mil in compensation.

So far, the report said SHSB had paid Alstom Power Asia Pacific Sdn Bhd RM80mil and BEM1-C Contract Consortium RM20mil.

The report also said up to November 2007, SHSB had paid BEM 1-C Contract Consortium RM317.64mil in deposit and progress payment although it had yet to sign a contract with SHSB.

"The absence of a contract may cause BEM1-C Contract not being liable if things go wrong," it said.

In the reply on points raised in the report, it said the contract had yet to be signed as disputes on clauses, including currency of payment, had yet to be sorted out.

It also said that SHSB and the Government had agreed to pay BEM1-C Contract RM145mil in compensation due to delay caused by MCHJV.

The AG's report said the delay in implementing the Bakun project was also caused by several changes in the target power generation capacity.

Meanwhile, 10 years after Bakun residents left their homes to make way for the dam, some of them have yet to receive full compensation for the relocation, said the report.

As of December last year, RM46.28mil had yet to be paid out as compensation.

The delay was due to families refusing to accept the compensation sum decided by the Sarawak Government.

Monday September 1, 2008

KUALA LUMPUR: The failure of Sarawak Hidro Sdn Bhd (SHSB) to take advantage of a lower ringgit-US dollar exchange rate for payment to one of its Bakun dam contractors caused it RM9.02mil.

The 2007 Auditor-General's report said that the sum could have been saved had the progressive payments from SHSB to contractor Malaysia China Hydro Joint Venture been converted to US dollars as stated in the contract.

The report showed that the first 15 progressive payments were converted from ringgit to a sum of US$26.43mil as stated in the contract and this had helped to save the company RM0.87mil due to a weaker US dollar.

The contract exchange rate was fixed at US$1 to RM3.826, but the prevailing rate at the times of payment was US$1 to RM3.389-RM3.816.

However, subsequent progressive payments were not converted and payment for a sum of US$44.14mil was made in ringgit using the fixed contract exchange rate.

This meant that Sarawak Hidro paid RM9.02mil more, when it could have paid only RM159.88mil if it had used the lower prevailing exchange rate.

The Auditor-General was of the view that Sarawak Hidro should have complied with the agreement in the contract to pay in US dollars.

In its reply, Sarawak Hidro said Malaysia China Hidro had applied to Sarawak Hidro to pay in ringgit although it was stated in the contract that 27.46% of the payment to be made in US dollars.

It said the matter was brought up in the board of directors' meeting on May 31, 2005, and the board decided to defer the payment until the pegging of the ringgit was lifted.

Following the lifting of the peg, Sarawak Hidro made the progressive payments in ringgit starting Sept 2005.

Sarawak Hidro, formed in 2000, was previously named Bakun Hidro Sdn Bhd, a company owned by Finance Ministry Incorporated, which took over the Bakun dam project from Ekran Bhd in 1997.

Thursday, March 29, 2007

Kyodo News

Nine Japanese shipping companies that transport lumber from Sarawak, Malaysia, allegedly failed to report some 1.1 billion yen of income in total during a period of up to seven years through last March, sources said Wednesday, alleging the money constituted kickbacks to Sarawak officials via a Hong Kong agent.

Such tax irregularities have occurred as the Tokyo Regional Taxation Bureau determined the companies' remuneration payments to Regent Star, a Hong Kong agent, which has a connection with Chief Minister of Sarawak Taib Mahmud and his family, were rebates, not legitimate expenses, the sources said.

Although the Hong Kong agency did very little in the way of substantive work, the shipping companies are believed to have used rebates as a lubricant to facilitate their lumber trade, the sources added.

Lumber export is controlled by the Sarawak state government on grounds of forest resources protection.

Rejecting the tax authorities' conclusion, the shipping firms claim the transactions with Regent Star have been legitimate and deny wrongdoing.

The companies accused of the alleged tax evasion include Mitsui O.S.K. Kinkai Ltd. and NYK-Hinode Line Ltd. belonging to the Nanyozai Freight Agreement (NFA), a cartel formed in 1962 to avoid excessive competition in import of lumber from Southeast Asia. The 12-member group is exempt from the Antimonopoly Law.

The shipping firms will likely be slapped with well over 400 million yen in back taxes along with heavy penalties, the sources added.

According to NFA and other sources, the Japanese cartel concluded an agreement in 1981 with Malaysia's Dewaniaga Sarawak regarding lumber transport. Dewaniaga is a state-affiliated concern in charge of lumber export control and is headed by the Sarawak chief minister's younger brother.

--------------------------------------------------------------------------------

Speech

by Chong Chieng Jen

--------------------------------------------------------------------------------

(Dewan Rakyat, Thursday): The principal Act (Government Investment Act 1983 [Act 275]) provides for the raising of funds by the Government of Malaysia for such period of time and payment of interest on the fund so raised. This Amendment Act seeks to provide for the raising of funds by the Government of Malaysia in accordance with the Syariah principles.

What I would discuss in my debate will not concern with the manner in which these funds are raised but rather the purpose and usages of the fund so raised, in what projects will these funds be invested by the Government. Funds raised by Government must be repaid in future. If the funds were not used wisely and the investments made with the funds incurred huge losses, then the Government will have to use public funds to repay these indebtedness.

Therefore, when we talk about investment by the Government, the most important things are "transparency and accountability" because we are talking about the management of public funds. The people in general has a right to know what has become of the funds used by the Government in various investments and whether these investments yield returns or suffer losses.

In Malaysia, it seems that the concept of "transparency and accountability" is not well understood or practised by the Barisan Nasional government. Since 1980s, financial scandals, one after another, were revealed but yet nobody seemed to be taking any responsibility for such mismanagement of fund. When the EPF is paying an all-time low dividend to the contributors, it is a shame that our government could still claim that it is doing well. Worst of all, despite such poor dividend return, the investment portfolio of EPF and the decision-making process in respect of the investments made by EPF are not explained to the people

Early this year, the Sarawak Government raised a fund of USD350 million through the issuance of trust certificates called "Sukuk", a bond issued by the Sarawak Government in accordance with the Syariah principles. The fund will be injected into one of the subsidiaries of the Sarawak Economic Development Corporation (SEDC) which is a statutory body incorporated by the Sarawak Government to spearhead the economic development in Sarawak.

The beneficiary company of this USD350 million fund is the company the Government labeled as "the brainchild of Sarawak" but one which I would label as "the Prodigal Son of Sarawak". The said company is 1st Silicon (Malaysia) Sdn Bhd.

1st Silicon (Malaysia) Sdn Bhd is a semi-conductor wafer foundry founded by the Sarawak Government in 1998. Its major shareholder is SEDC who holds approximately 70% of the total shareholding in 1st Silicon (Malaysia) Sdn Bhd.

From a company search conducted with the Suruhanjaya Syarikat Malaysia, it is revealed that 1st Silicon has a total paid up capital of RM1.827 billion out of which RM1.291 billion belongs to SEDC, RM421 million belongs to Sovereign Capital Berhad and the remaining RM160 millions belongs to private parties.

LIABILITIES of 1st Silicon (Malaysia) Sdn Bhd

Beside having a large equity base of RM1.874 billion, 1st Silicon (Malaysia) Sdn Bhd has, since its inception, not stopped raising huge loans from international financial institutions. I have with me a list of news releases by 1st Silicon itself regarding the number of loans raised by it over the years.

· In March 1999, 1st Silicon obtained a Syndicated Loan of USD 200 million from Export Credit Agency of the Federal Republic of German.

In May, 2000, it obtained a Syndicated Loan of USD 80 million from US Export Import Bank.

In July, 2000, it obtained a Syndicated Loan of USD 180 million from Noruma International plc.

In August, 2000, it obtained a loan of USD 59.5 million from Japan Bank for International Cooperation.

In December, 2000, it obtained a Syndicated Loan of USD 93.75 million from Standard Chartered Bank.

In June, 2001, it obtained a Syndicated Loan of USD 250 million from Noruma International plc.

In October, 2002, it received a new round of financing totaling USD 614 million in equity and credit. Out of the said sum of USD 614 million, USD 290 million was additional equity raised since January, 2002. The remaining USD 324 million was by way of loan of USD 120 million from Japan Bank for International Cooperation and related commercial banks and USD 204 million from US Export Import Bank.

In December, 2004, the Government of Sarawak issued 5-year Islamic bond to raise a sum of USD 350 million for injection into 1st Silicon (Malaysia) Sdn Bhd.

From the above figures, it is shown that a total credit facility of USD 1,537.25 million was raised by 1st Silicon (Malaysia) Sdn Bhd since its inception, not including the equity participation by the Sarawak State government into the company.

Most importantly, all these loans are guaranteed by Sarawak Government.

PERFORMANCE OF 1st Silicon (Malaysia) Sdn Bhd

With such great sum of loan facility and equity participation by the Sarawak Government, we must be concerned about the performance of the company and the prospect of this company.

The Income Statement of the Company showed that the company has been making huge losses since its operation. The Company's 1998 account did not show any profit and loss and I could not obtain copies of the Company's 1999 account statement from the Suruhanjaya Syarikat Malaysia. However, I can show this August House that the astronomical losses of this company since the year 2000.

In the year 2000, the Company suffered a loss of RM74 million.

In the year 2001, the Company suffered a loss of RM809 million.

In the year 2002, the Company suffered a loss of RM881 million.

In the year 2003, the Company suffered a loss of RM727 million.

The loss of 1st Silicion (Malaysia) Sdn Bhd in the year 2003 alone is great than the total allocation of fund for the development of roads and bridges in Sarawak under the 2005 Budget which is only RM627.34 million.

Since the incorporation of the company in 1998 until 31-12-2003, it has suffered a loss in the total sum of RM2.5 billion. This figure is great than the total fund allocated for the development of roads and bridges in Sarawak under the 5-year 8th Malaysia Plan (2001 – 2005) which is only RM2.45 billion.

FEASIBILITY AND ECONOMIC VIABILITY of 1st Silicon (Malaysia) Sdn Bhd

To see whether the investment in 1st Silicon (Malaysia) Sdn Bhd is feasible and economically viable, one has also to look at company's account in terms of its revenue and cost of sales. Cost of sale are costs incurred in order to produce. If cost of sales is less than the revenue, than there is still some viability in the project, but if cost of sale is greater than the revenue, than there is no viability and future in the project at all.

For the year 2002, the revenue of 1st Silicon (Malaysia) Sdn Bhd was RM113 million and its cost of sale is RM505 million.

For the year 2003, the revenue of 1st Silicon (Malaysia) Sdn Bhd was RM170 million and its cost of sale is RM550 million.

In general, the ratio of cost of sale to revenue of 1st Silicon (Malaysia) Sdn Bhd is 4 to 1. This means that for 1st Silicon (Malaysia) Sdn Bhd, to earn RM1, it has to spend RM4. The more products it sells, 4 times more than the revenue has to be spent.

There is no future for this project and it ought to be stopped.

In answer to a question by a Member of Parliament from Barisan Nasional asking that if there is no viability in the project, why 1st Silicon (Malaysia) Sdn Bhd can raise so much loan internationally and that the latest Sukuk loan has a high rating from the international firm Standard and Poor, my reply is that 1st Silicon (Malaysia) Sdn Bhd was able to raise loan because of the guarantee by Sarawak Government and the high rating on Sukuk trust certificate is because it is guaranteed by the Sarawak Government, not because of the performance of 1st Silicon (Malaysia) Sdn Bhd.

TECHNOLOGY APPLIED by 1st Silicon (Malaysia) Sdn Bhd

In terms of advancement of technology, 1st Silicon is also generations behind its competitors worldwide. 1st Silicon is still producing wafer by using 0.25 micron technology process. On the other hand, its contemporary in West Malaysia is producing wafer by using 0.15 micron technology process and will be producing wafer by using 0.13 micron technology process in this year.

Worldwide, in Taiwan and United States, the foundries are experimenting on 0.09 micron technology process.

From 0.25 micron technology, there are 0.22 micron technology, 0.18 micron technology, 0.15 micron technology, 0.13 micron technology. It is clear that the technology employed by 1st Silicon (Malaysia) Sdn Bhd is few generations behind the latest technology.

GOVERNMENT AUDIT REPORT

The loss incurred by 1st Silicon (Malaysia) Sdn Bhd for the year 2003 is RM727 million. This is definitely a material financial information which ought to be highlighted by the Ketua Audit Negara in its audit of Sarawak Government for the year 2003.

If such a glaring loss in the accounts of a subsidiary of a statutory body cannot be picked up by the Audit Department, what control measures and confidence can we have to ensure that the investment made by the Minister is proper and gives reasonable return. Not only did the Ketua Audit Negara failed in its duty to detect and highlight the astronomical losses of 1st Silicon (Malaysia) Sdn Bhd, but in its general statement, it claims that the general financial management of Sarawak Government is good.

In the whole audit report of the Sarawak Government, there is no single word mentioned about 1st Silicon (Malaysia) Sdn Bhd. It only mentions that the income of SEDC for the year of 2003 is RM58.28 million whereas its expenses is RM26.03 million. Where has the figure of RM727 million loss of 1st Silicon (Malaysia) Sdn Bhd gone? Under proper accounting practices, the accounts of a subsidiary must be consolidated into the group account of the holding company. SEDC, being a holding company of 1st Silicon (Malaysia) Sdn Bhd, must include in its yearly reports, the financial statements of 1st Silicon (Malaysia) Sdn Bhd.

Besides 1st Silicon (Malaysia) Sdn Bhd, what are the other investments made by SEDC and whether they yield positive returns or losses. I hope in the audit report for year 2004, the Ketua Audit Negara can furnish the whole list of SEDC investment so that the Parliament can better perform its duty in holding the executive accountable.

The Ministry should not only know how to seek the approval from the Parliament to allow him to raise funds, but should also be answerable to the Parliament in the manner in which the funds so raised are used.

(28/4/2005)

* Chong Chieng Jen, DAP Member of Parliament for Bandar Kuching

There are many more cases of clear corruption , but it's too many and tedious to list them all out here.

If some of you are still sleeping, wake up.

2 comments:

In protest of the excesses of Sarawak Government, especially the controversial dam, I have tempered wuth my SESCO Meter and only allow the blade to run for 3 days a month.

Reasons:-

1. Our Meters are faulty and our meter reading is plus/minus 10%.

2. A random survey reaveals that most end up in the "plus" zone.

3. This Meters can be calibrated and I am puzzled why it can not be the otherway round of a slight "Minus".

4. If the authorities can take what we earn and work for, I might as well steal elecitricity as they are stealing from all electricity consumers.

5. If you delay payment, they charge you $10.00 for reconnection fee.

So I call on all Sarawakians to do the same and let us see:-

1. how many can SESO Prosecute

2. how Taib Mahmud want to play rough with us since he is government and he forget that he is put there by us.

3. i also want to see how he will mobilise a notorious gangster to intimidate the rakyat.

To Headhunter, most of what you say is true.

Let us all rise up and stand challenge this arrogant Government.

I maintain, if any of the Politicians dare to swear:

1. In front of their ancestral grave

2. Their Love ones and children

that they have never been in a corrupt act, I will crawl the streets naked and eat all the gravels along the way!

wah you become more and more daring. I hope you don't get yourself in trouble just like the stupid RPK.

Post a Comment