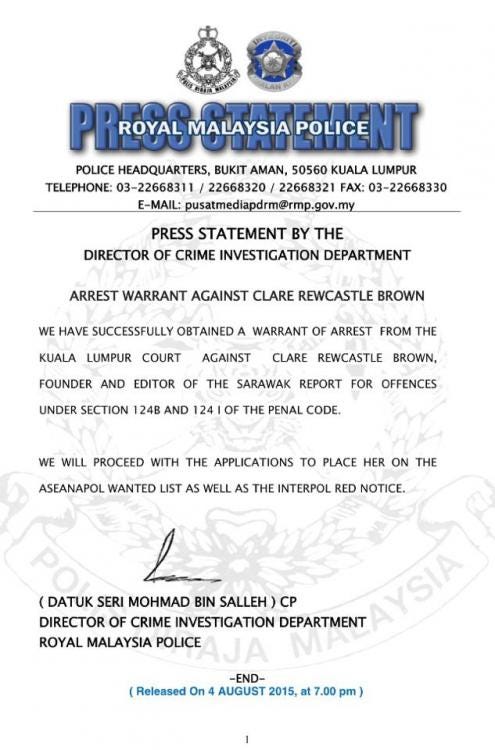

SENSATIONAL FINDINGS! - Prime Minister Najib Razak's Personal Accounts Linked To 1MDB Money Trail MALAYSIA EXCLUSIVE!

2 Jul 2015

(Reproduced with permission)

This post is also available in:

Malay,

Iban

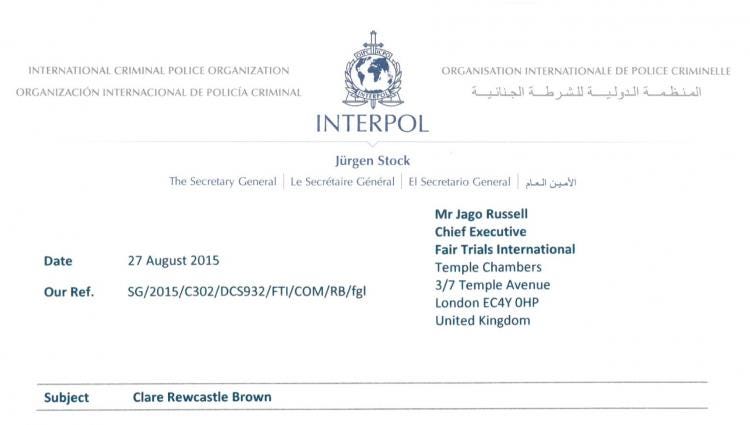

Mohamed

Badawy al-Husseiny CEO of Aabar was also Chair of Falcon Bank at the

time of the multi-million dollar transactions into Najib’s account and

he remains a current Board Member at the Aabar/IPIC owned bank.

In a shocking development it has been learnt that investigators have

traced billions of ringgit linked to the 1MDB money trail into Prime

Minister Najib Razak’s personal bank accounts.

Amongst a series of key transactions it has been identified that a

total of RM42 million recently flowed from a controversial company

linked to 1MDB, SRC International Sdn Bhd, into the PM’s own private

accounts.

These personal accounts were held clearly under the name of “Dato’Sri

Mohd Najib Bin Hj Abd Razak” at AmPrivate Banking in Kuala Lumpur.

Even more sensationally, a total of US$681,999,976 (RM2.6 billion)

was separately wire transferred from the Singapore branch of the Swiss

Falcon private bank owned by the Abu Dhabi fund Aabar into the Prime

Minister’s private AmBank account in Kuala Lumpur, on March 2013, just

in advance of the calling of the General Election.

AG Abdul Gani Patail – the information is on his desk

Aabar has been connected to numerous financial transactions involving 1MDB.

The transfers from the fund’s wholly owned Falcon Bank into Najib’s

AmPrivate Banking account took place just days after the signing of a

so-called “strategic partnership” between Malaysia and Abu Dhabi on 12th March 2013.

However, there have been many queries since about what happened to

the money; about the failure to develop the Tun Razak Exchange project

and about why Aabar itself never contributed, as promised, to the

so-called joint venture?

Posing

at the photo shoot to promote the “Strategic Partnership”just days

before the cash transfer from Falcon and three weeks before parliament

was dissolved, were the Malaysian Prime Minister Najib Razak; the CEO of

1MDB (Shahrol Halmi); the Chairman of 1MDB (Lodin Wok Kamaruddin); the

Chairman of Falcon Bank and CEO of Aabar (Mohamed Badawy al-Husseiny)

and the Chairman of Aabar (Khaddem Al Qubassi).

This stunning body of banking information has recently been received

by a number of Malaysia’s top law enforcers, including the Attorney

General.

It creates an extraordinary series of connections between 1MDB

projects and the Prime Minister’s personal finances and it transforms

the 1MDB investigation into a political crisis of the gravest magnitude

in Malaysia.

SRC paid RM42 million to Najib Razak’s private accounts

The money taken from SRC International is a particularly shocking

revelation, because this was money lent by the public pension fund KWAP

and never accounted for.

SRC International Sdn Bhd was set up under the auspices of 1MDB in

July 2011 and it is headed by none other than Nik Faisal Ariff Kamil, a

close friend of Jho Low, who was brought over to 1MDB from Sarawak’s UBG

as the fund’s chief investment officer.

Najib’s personal bank accounts move centre stage in the hunt for 1MDB’s missing billions

In 2010 Nik Kamil was the ‘link man’ between UBG, 1MDB and PetroSaudi

for channelling US$260 million of 1MDB money into the purchase of UBG

from Jho Low and the then Sarawak Chief Minister Taib Mahmud.

He was then transferred to become CEO of 1MDB’s new subsidiary SRC International Sdn Bhd.

SRC International courted immediate controversy in 2011 by borrowing

RM4 billion from Malaysia’s public retirement fund Kumpulan Wang

Persaraan (KWAP).

Over subsequent years 1MDB’s political critics have pressed the

government to understand where that money went and have repeatedly

complained at the lack of information provided by the company’s

statements and accounts.

Most recently the Prime Minister, who had eventually taken SRC under the direct control of his own Ministry of Finance, announced in March that much of the money had been invested in a Mongolian company Gobi Coal & Energy.

However, documents now in the hands of Malaysian prosecutors, show

that just the previous month (February 10th 2015) SRC International had

transferred RM10 million into the account number 2112022011880 of

“Dato’ Sri Mohd Najib Bin Hj Abd Razak” at AmPrivate Bank in Kuala

Lumpur.

Transfers this year in February from SRC into Najib’s personal account

Likewise, on December 26th 2014, two earlier transactions had seen

the transfer of another RM27 million and RM5 million from SRC

International Sdn Bhd into AmPrivate Banking account number

2112022011906, which also belongs to “Dato’Sri Mohd Najib Bin Hj Abd

Razak”.

Transfers last December from SRC into Najib’s personal accounts

The money trail from SRC International to Najib has been clearly

detailed by investigators and is also in the possession of the

international financial newspaper The Wall Street Journal.

Sarawak Report has acquired copies of the documentation relating to

the case, which corroborate that out of a total of RM50 million

transferred from of SRC in these transactions RM42 million went straight

into the Prime Minister’s own accounts.

The findings present a clear flow of money from SRC International’s

AmBank Islamic account number 2112022010650 through two separate

Malaysian companies into two of Najib’s own personal accounts at the

AmBank Group’s private arm.

The transfers first passed from the 1MDB/ Ministry of Finance owned

company, SRC International Sdn Bhd, whose Director and CEO is Nik Faisal

Ariff Kamil, to a second company Gandingun Mentari Sdn Bhd, of which

Nik Faisal Ariff Kamil is also a Director and SRC is the major

shareholder.

This account was also held at AmBank Islamic, account number 8881003806948.

Key role of Nik Faisal Ariff Kamil at SRC and transfer company Gandingan Mentari Sdn Bhd

Then the money was transferred on to another company Ihsan Perdana

Sdn, of whom the shareholders of a share capital of RM100,000 are one

Datuk Suboh Bin Mohd Yassin and again Nik Faisal Ariff Kamil.

Ihsan Perdana Sdn Bhd was the second company in the trail with an account at Affin Bank.

The Ihsan Perdana account number 106180001108 is lodged with another

Malaysian bank, Affin Islamic Bank, of whom one of the Board members is

none other than Lodin Wok Kamaruddin, who is also Chairman of the Board of Directors of 1MDB.

Key link in the chain – Lodin Wok Kamaruddin is Chair of 1MDB and Board Member of Affin Bank

Two days after the first transaction initiated on Christmas Eve, the

vast majority of this original RM40 million sum was passed on Boxing Day

2014, in two tranches, to two separate accounts belonging to Najib.

RM27 million went to his personal AmPrivate Banking account number

2112022011880 and RM5 million went to his personal AmPrivate Banking

account number 2112022011906.

SRC International – February 2015 pay out

The investigation shows a second series of payments, which took place

in February of this year, following the same pattern of transactions.

On this later occasion SRC International first paid out RM5 million

on 5th February 2015 to the Nik Faisal Ariff Kamil controlled company

Gandingan Mentari Sdn Bhd. Then the next day on 6th February a further

RM5 million was transferred to the same account.

Lodin and his team at Affin Islamic Bank

Each sum was immediately transferred within the same day to the same Ihsan Perdana account as before at Affin Islamic Bank.

Later, on 10th February, the entire combined sum of RM10 million was

forwarded straight into one of the personal accounts at AmPrivate

Banking used in the previous transactions – Account Number

2112022011906, registered in the name of “Dato’ Sri Mohd Najib Bin Hj

And Razak”.

The transfer documents cite the purpose of the money as being for

unspecified “CSR [Corporate Social Responsibility] programmes”. Why

such a programmes would ever be conducted through the private accounts

of the Minister in charge of the public company out of borrowing from

the state pension fund remains unclear.

Falcon Bank is a discreet bank promoted towards the super-wealthy. It is owned by Abu Dhabi’s Aabar Fund.

US$680,999,976 from Falcon Bank straight to Najib!

A further extraordinary transaction cited in this official

investigation into 1MDB will attract the particular interest of

international and US regulators, not only because of its shocking size,

but also because it comprises a US dollar transaction through Wells

Fargo Bank in New York.

Hundreds

of millions of dollars wired from a BVI company account at Falcon Bank

(Tanore Finance) to Najib’s personal AmPrivate Bank account days before

the calling of the 2013 General Election

Malaysian followers of the 1MDB scandal will note that familiar names

linked to 1MDB and Jho Low at the Abu Dhabi Aabar fund are closely

involved.

Khadem al Qubaisi, ex-head of Falcon, Aabar and CEO of IPIC

Falcon Bank,

which sent these enormous sums in March 2013, is a Swiss Private Bank,

formerly called AIG Private Bank, which was bought up by IPIC (of which

Aabar is a subsidiary) in 2009.

The original Chairman of the Board of Falcon Bank was none other than

Khadem al Qubasi, the Aabar Chairman and IPIC CEO, who was at the heart

of a series of controversial deals with 1MDB and simultaneous private

ventures with Jho Low.

Al Qubaisi was sacked from all his official posts in Abu Dhabi earlier this year, following a series of exposes

in Sarawak Report about his dealings with 1MDB, his extravagant and

unaccountable wealth and his flamboyant behaviour in nightclubs – as

well as a mysterious payment of US$20 million into his private account

by the company Good Star in 2012.

Good Star was controlled by the 1MDB connected businessman Jho Low

and the company was the recipient of US$1.19 billion siphoned off from

the PetroSaudi joint venture, according to investigations by Sarawak Report.

Al Qubaisi was succeeded as Falcon Chairman by his CEO at Aabar, Mohamed Badawy Al-Husseiny.

Both these men have been closely involved in all the various deals

between Aabar and 1MDB and it was Badawy Al-Husseiny who was in the post

as the Chairman of Falcon when the massive transfers of hundreds of

millions of dollars were made to Najib’s account in March 2013.

More deals involving Aabar’s Khadem al Qubaisi and Mohammed Al-Husseini – Aabar purchased a share of RHB bank in 2011

Indeed Al-Husseiny remains on the Falcon Board to this day and also

remains in place as Chief Executive of Aabar, which is a subsidiary of

IPIC, which has just controversially bailed out 1MDB by agreeing to pay

its outstanding debts of US$1 billion and to indemnify its repayments on

a further $3.5 billion, in return for promised “assets” that have

remained unspecified on the London Stock Exchange.

Despite the promise by the Malaysian Government that it would not agree to guarantee further

loans to 1MDB, the LSE announcement has made clear that the Prime

Minister has indeed made just this commitment to IPIC in this published

agreement.

Close

connections – Riza Aziz and Jho Low at the launch of Wolf of Wall

Street – allegedly paid for by Aabar’s CEO and Falcon Bank’s Chairman

Al-Husseiny

Interestingly, it was none other than the same Mr Husseiny who, after

months of speculation, finally came forward to claim that it was he who

personally invested the US$100 million in the Hollywood Movie Wolf of Wall Street made by Red Granite Productions, which belongs to Najib Razak’s step-son Riza Aziz (son of Rosmah Mansor).

No one has been able to explain how a salaried official like Mr Husseiny could afford to make such a vast one off investment in the first major movie project of a son of a client.

The detail on the transactions

The transfers made by Falcon Bank’s Singapore branch to Najib Razak’s

personal account just days before the Prime Minister called the last

election are eye-wateringly large.

On 21st March 2013 US$619,999,988 was paid out of account number

8550299001 at Singapore’s Falcon Private Bank, which is registered in

the name of a BVI company named Tanore Finance Group.

This money was sent to yet another account registered in the name of

“Dato’ Sri Mohd Najib Bin Hj And Razak” at AmPrivate Banking in

Malaysia. The number of this account was 2112022009694.

Hundreds

of millions of dollars wired from a BVI company account at Falcon Bank

(Tanore Finance) to Najib’s personal AmPrivate Bank account days before

the calling of the 2013 General Election

The documentation also shows that a second payment was made four days

later on 25th March 2013, via the same transaction channels, of

US$60,999,988 into the same account belonging to Najib.

This account was closed, according to our information, on 30th August of that year.

During the intervening period was the GE13 election campaign, where

the issue of vote buying featured heavily. It therefore seems

inevitable that questions will now be asked whether the Prime Minister

was using this transfer of money as a personal ‘election fund’?

Indeed UMNO candidates have confided that Najib handed them multi

million personal cheques, signed by the Prime Minister himself, in order

to cover election expenses.

Suspicious transactions

Also at issue is whether the banks involved ever alerted regulators

to the possibility of a suspicious transaction, according to money

laundering regulations?

The wire transfer documents show that these multi-million dollar

transfers were handled through New York by the American Wells Fargo

Bank, International Branch.

The revelations will inevitably prompt calls for the regulators in

Singapore, Switzerland and now the United States to examine the

activities of a Swiss private bank based in Singapore through the US in

paying such a sum into the private account of a politically connected

individual.

Malaysia’s own regulatory authorities, on the other hand, have been presumably paralysed by the notorious and long-standing refusal of the Attorney General, Abdul Gani Paital, to ever prosecute cases involving senior members of UMNO.

Role of Nik Faisal Ariff Kamil is revealed

Nik Faisal Ariff Kamil – key link between 1MDB, Najib and Jho Low

Another fascinating aspect of this investigation is the revealing of

the pivotal role of Jho Low’s known close side-kick Nik Faisal Ariff

Kamil in the close circle of operators around Najib Razak.

A letter from Nik to the branch manager of AmIslamic Bank in Jalan

Raja Chulan, KL dated 20th January 2014 reveals his management of

several of the bank accounts owned by Najib, including two involved in

the SRC investigation.

Nik Kamil refers to three accounts, 211202201188-0/211202201189-8/211202201190-6, for which he reveals he has been

appointed “Authorised Personnel” with the right to deposit cash.

Because he and the account holder (Najib Razak) have schedules

involving “various international trips and meetings scheduled and other

potential ad hoc requirements”, he explains to the branch manager that

there will be occasions where he “may not be available to provide

necessary transfer and remittance instructions to the Bank”.

He therefore wished to nominate a representative to “arrange for

urgent cash deposits into the accounts where required for purposes of,

inter-alia, clearances of urgent cheques against my instruction”.

This revelation shows that Nik Faisal Ariff Kamil is not only the

Director of the 1MDB subsidiary SRC, but also the manager of private

accounts owned by Najib Razak, which have received money from that

company.

This new information, related to the on-going scandal of 1MDB and

already being reported internationally, is likely to send shock waves

through Malaysia’s banking and political circles.

Whatever the excuses (an of course there will be attempts at plenty)

such vast transfers of money into a sitting Prime Minister’s private

account cannot be ignored.

Neither can the unorthodox and irregular handling of public

borrowings from an old age pension fund entrusted once again to the same

Prime Minister cum Finance Minister, who allowed money from SRC to also

pass into his personal accounts.