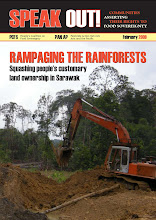

Comments by Sarawak Headhunter in red.

Friday, August 07, 2009

Idris Jala bullshit results, 2nd Qtr operating loss worsens

MAS announced it's second quarter results today. Net profit was RM876 million and offset the first quarter loss of RM695 million for a first half profit of RM181 million.

MAS announced it's second quarter results today. Net profit was RM876 million and offset the first quarter loss of RM695 million for a first half profit of RM181 million.

That announcement managed to brush aside analysts' expectation of further loss. Why bother about these life is a straight line forecast and everything remain the same like before analysts?

With the new accounting scheme of mark-to-market for any outstanding futures hedging, the real number that needs highlighting was intentionally hidden. Read on to know the stories shrouding their fuel hedging debacle.

The financial presses were really being 'bodoh'. None bothered to ask about the operating profit and loss. In the first quarter, MAS posted an operating loss of RM138 million. What was the second quarter like?

Read the Bernama report first below:MAS Posts Net Profit RM876 Mil In Q2

All that bullshit about rising load factor and yet no mention of operating P&L.

KUALA LUMPUR, Aug 6 (Bernama) — Malaysia Airlines (MAS) posted net profit RM876 million in the second quarter ended June 30, 2009, the highest ever quarterly net profit recorded by the airline.

This profit offsets the national carrier’s RM695 million net losses in the first quarter, leading to a first-half net profit of RM181 million.

Due to the oil price recovery since March 31, 2009, MAS’ fuel hedging losses of RM640 million in the first quarter has been reversed with a RM1.3 billion gain in the second quarter, the airline said in a statement.

Since the beginning of the year, the airline has implemented aggressive sales campaigns to deal with the worst crisis facing the industry.

It successfully increased its load factor to 66 per cent in the second quarter, a double digit growth of 10 per cent compared to 56 per cent in the first quarter.

In response to the growing demand, with the domestic load factor up by 69 per cent in the second quarter, it said the national carrier had increased the capacity by six per cent by adding more aircraft for the domestic sector.

The airline also made substantial load factor gain for its international routes with loads up 11 per cent to 65 per cent compared to 56 per cent in the first quarter.

“We are managing well in this crisis. While the operating environment remains tough, the load factors have increased due to our aggressive strategies to boost sales.

“On the domestic front, more passengers are travelling with us,” managing director/chief executive officer Datuk Seri Idris Jala said.

“On international routes, we have performed better than the industry average as we are less dependent on the front end,” he said, adding that the airline forecast booking numbers for the second half of the year are encouraging.

So this super Orang Ulu Idris Jala is revealed as being just another bullshitter. The reward: make him a Federal Minister so that he can teach Najib and the rest of the Cabinet how to bullshit properly.

In the first place, load factor is the old variable to manage an airline. Pushing for purely load factor was the one that got former Managing Director Dato Fuad the boot for taking MAS into loss territory immediately after the financial restructuring. The fancifully named sell and leaseback scheme made Azman Mokhtar's Binafikir famous.

The important variable today is revenue per seat.

Before announcing MAS's operating loss, this is what was heard of MAS' fuel hedging scheme. They left it to the total discretion of Investment Banker Morgan Stanley Singapore. Upon realising the mess Morgan had made, they were considering of hiring an oil futures trader, which they should have done in the first place, but he declined. The whole market has been talking about their messed up oil hedge position.

It is unheard of to totally out-source one's financial market hedging to others who are without knowledge of the whole company's financial variables and constraints. Off course, this is market talk. It is usually more rumour than the truth. But beware that market talk moves markets.

The absurd part of this is the much confidence given to Dato Seri Idris Jala to weather the storm from the oil crisis. That was the story sold to have him extend his stay at MAS. MAS also had highly paid accountants like foreign-trained Tengku Azmil and the many spectacled young Ah Piows from Ernst & Young.

The truth is the Butcher from Shell was never an oilman. He must have butchered all those with experience in fuel hedging within the Treasury team built from the days of Encik Shahril and Low Chee Ting. Now this is the time to repeat my incessant and repeated complaint of young inexperienced know nuts brought into MAS to replace those experienced and appropriately described as knowledge workers.

Idris Jala it seems is nothing more than an oilyman.

The mistake by Tun Lah to entertain the recommendation of Idris Jala by Kamaluddin's friend is also the second quarter operating loss of RM421 million. And that is a further deterioration from RM138 million in first quarter.

So what the f**k is this talk of rising load factor? Don't bullshit about net profit. If your operation doesn't make money, how are you to keep the Company afloat?

Oh yes, the 2nd quarter operating figure is also rumour. So don't sue.

Sunday, August 09, 2009

Why Idris Jala did not reveal and financial press not ask about MAS' operating loss?

Looks like Sarawak has its own highly-paid Pinnocchio trying very hard to fly high but falling flat instead. Do the orang Malaya really believe all his crap? Very sure they know what is really going on.

It is impossible for the financial press to not ask about MAS' operating profit. Unless MAS has transformed the company's core business into jet fuel arbitrage, the operating P&L remains relevant. Hmm ... MAS a jet fuel arbitrage company, that's a niche business idea.

It is from the operating profit that cashflow is generated to maintain the company as an ongoing concern and eventually turn around MAS. Operating profit will translate into the net profit, which God willing could be used to reduce any accumulated losses. Without operating profit, MAS will continually be sucking money from the Treasury.

P Gunasegaran wrote here on similar issue raised in the previous posting. However, he did not pick up where we left off. Kalimullah's contemporary should ask why Idris withheld the information and the financial press including The Star did not ask?

It is simple. In fact, Idris used the same generic corporate trick before. By withholding the operating loss, the financial press will highlight on "capital gain" from hedging revaluation. Still, why did he do it?

Idris Jala reminded me of Tan Sri Nor Mohamad Yakcop's past statement to praise him as the best CEO money can buy. See the newspaper clipping below:

Wonder what made Nor Mohammad impressed by the so-called turnaround done by the Butcher from Shell?

Obviously Idris has been bought and paid for by the ruling BN regime and must now justify his position and use to them.

The Butcher merely reduced overhead by retrenching experienced Airliners but later hired young cikus with zero Airline experience, placed them in numbers at various levels of management, and paid them much higher scale than the senior retrenched staff.

The Butcher retrenched the experienced ones so that they are no more a pain in his ass to nag him of his amateurish manner in running a full service Airline. He brought in lots of Ah Piow accountants from Ernst and Young who got no shindick knowledge of Airlines.

If there are consultants like Booz Allen Hamilton, McKinsey & Co. and Ethos Consulting, then you know Khairy and Tingkat 4 have their hand in it. For sure, Khairy and Zaki Zahid had a direct hand to change the National Aviation policy in favour of Airasia. Part of the money went to MyTeam.

Idris did the predictable reorganising of routes. He intended to cut the not profitable routes but Khairy and the corrupt MCA Transport Ministers forced them to give some profitable routes to Airasia. The routes cut the company's capacity, which means limiting capacity to generate profit potential for the future.

Is it a surprise MoF II could claim Idris as the best CEO money could buy?

All along, MAS was not performing well operationally. Thus the second phase of the turnaround plan is to show MAS generating operating profits. That way he could get an extension on his contract.

For that he sold MAS buildings and assets locally and abroad. With the smart and manipulative accounting mind of Tengku Azmil, the capital gain appears on the operating profit column.

That's the past. It's too time consuming to display what happened with facts and figures. Coming to the question again, why did he unethically manipulate the results announcement?

See the headline by The Malaysian Insider with its link below:

The link here.

Doesn't that explain everything? With the aviation industry at a loss, doesn't Idris Jala look impressive for being able to outperform the industry?

MAS Adviser is in slumberland to notice such small but relevent technicality. He is likely to say MAS did well when others are losing. His circle of people are still operating. Kalimullah, crony to sleepy and Nor Mohamad Yakcop assisted MAS with this lie with the hope to make sleepy look good. See the headline given by The Malaysia Insider.

This is a clear cut con job by Idris Jala, Tengku Azmil and Kalimullah. If there is nothing coming from the authorities, then Tan Sri Nor and Tan Sri Azman Mokhtar are together in this lie. Khazanah has yet to turnaround MAS, Proton and Renong/UEM Group since they were first assigned to turnaround GLCs.

KPI?

P/S MAS used this blog for it's internal Leadership High Development course to show the natural occurrence of rejection towards new management. Hope they continue to do so and be sure to distribute this and previous postings. They need to prepare for another rejection because these postings will be sent to high places.

Friday, 28 August 2009

From Sakmongkol AK47

Responding to Anwar’s Ngajat?

Anwar's Ngajat?Neutralising Anwar Ibrahim's Ngajat overtures! That's the only rationale I see behind Idris Jala's appointment.

In 1975 when I was in 6th form at SABS Kuantan, my Economics teacher, Mr Tan Kee Chow, gave us one of the most practical adages. If you borrow RM500,000 you are at the mercy of the bank. But if you borrow RM500 million, the bank is at your mercy. It couldn't be truer these days. Present day translation: - If you want to make a mistake, make a gigantic and noisy one. You will get promoted to minister.

What KPI will Idris Jala be implementing? His record at MAS is a very much overhyped one. Losses are masqueraded behind balance sheet cleansing. MAS' assets are sold for a song. MAS will be having no assets at all. But he has been regarded as the best CEO money can buy. Who does this assessment? The vadey eating Nor Yaakob. Isn't he the one the last time who paralysed Bank Negara with gargantuan losses in the currency market? He made it to finance minister and now heads the EPU. He is now the stumbling block to the proposal by a group to take over road toll concessionaires. Helo mister, that's RM50 billion into the government's coffers. Wang masuk lah, bukan wang keluar.

That's also the 2nd Great Highway Robbery about to commence, and Mohd Nor probably just wants to make sure he gets his hands on his share of the proceeds. RM50 billion into the government's coffers from where? From the rakyat for them to waste some more?

The only rationale I see with Jala's appointment is Sarawak politics. He is a Dayak - Pak Lah thought he was a Muslim and so he got his chance of becoming MAS CEO. In Sarawak, the survival of BN hinges upon Dayak support who form the majority group. After years of neglect and sidelined, Idris Jala's appointment is perhaps a big consolation to soothe things out. It is hoped by this appointment, Dayak support to the BN will be secured. I hear Anwar Ibrahim is already learning to do the ngajat dance.

But it can also be seen as an excuse to kick out this Dayak from slashing and burning MAS further.

The government's KPI now is winning the trust of the people immediately. Its KPI is key groups targeting. Its KPI is bringing immediate benefits to the lumpenproletariat who don't give a hoot about the 30% quota requirements, or hak here and hak there. The younger generation is repelled by UMNO's positions-for-thievery political philosophy. The younger generation is a thinking public. It is now thinking, for what practical purpose is the appointment of a person responsible for hoodwinking the public that MAS is profitable made?

Partners in crime must always be rewarded appropriately, and if there is a potential political benefit from it, so much the better. We are just seeing another crony in the making.

Idris Jala has indeed made all Sarawakians proud. Sarawak Boleh! Boleh terbang wau lah!

2 comments:

We would like to offer clarification pertaining to our Q2 financial results announcement in August.

We made a conscious decision to be an early adopter of the Financial Reporting Standard 139 (FRS139) beginning FY09. When we announced this in May, we highlighted that we wanted to ensure that we were aligned to how other full service carriers reported their results and to ensure transparency around our results.

Due to the unprecedented collapse in oil prices after reaching a historical high in July 2008, most airlines were hit with significant mark-to-market (MTM) loss positions on their fuel hedging portfolio.

Obviously, we at Malaysia Airlines were not spared as we practice competitive hedging and the early adoption of the FRS139 enabled us to be transparent about our MTM position. Prior to FY09, there was no urgency to adopt FRS139 as our MTM position was not significant.

In our Q209 results announcement filed in Bursa, under part B review of performance, we first announced that MAS recorded an operating loss, followed by derivative gains and net profit. During our result briefings, we walked the media and analysts through our P& L in terms of revenue, expenditure, operating loss and net profit. We had robust discussions on yield, seat factors, operational losses and ways to increase revenue, operating cash flow and fuel hedging.

The financial figures including the operating losses were reported by The Star and The Edge as below:

The Star: Malaysia Airlines (MAS) reported an operating loss of RM420.8mil but exceptional derivative gains of RM1.34bil on fuel hedging resulted in the carrier reporting a net profit of RM876mil in the second quarter ended June 30.

Source: http://biz.thestar.com.my/news/story.asp?file=/2009/8/7/business/4473457&sec=business

The Edge Financial Daily: The group recorded an operating loss of RM420.8 million in 2Q compared with profit of RM62.0 million a year ago mainly due to lower operating revenue in line with the declining trend in global travel and cargo movements resulting from the current economic downturn.

Source: http://www.theedgemalaysia.com/business-news/146702-flash-mas-posts-rm876m-net-profit-in-2q.html

Interestingly, the media at the results briefing asked the same question you did – will Malaysia Airlines be profitable as the yields have dropped even though the load factor is up? In comparing Q109 vs Q108, our yields went up 4% but our load factor was down 56% as all the airlines were discounting their fares heavily. For Q209, we have decided to drop our yields in order to increase the load factor, rather than keep the yields up and lose the passengers. This strategy worked and our systemwide load factor for Q209 was up 10% to 66% compared to Q109. With more passengers flying with us, we can now work on increasing our yields.

We are facing the worst crisis ever. Many airlines are registering losses at the operational level. This includes regional airlines like Singapore Airlines and Cathay Pacific. We are not immune from this. Like all the other airlines, we are facing huge challenges.

We are doing everything we can to boost our revenue, conserve cash, and manage costs. We are on the right track with attracting passengers as our loads are up by more than 10% to 66% in Q209. Our forward booking loads are up.

We are aggressively pushing sales, and some 15 campaigns for Malaysia and 30 for global markets have been lined up for the rest of the year.

We expect the economy to recover next year, and are looking forward to take delivery of our new B737-800 in late 2010 to capture the expected growth. We are reviewing aircraft requirements according to supply and demand, and realigning our capacity to tap into the growth in demand.

We will increase our frequencies into key ASEAN capitals, South Asia, China and offer more flights to certain points in Australia. In the Middle East, we are looking at expanding our services.

The full clarification by Tengku Azmil Zahruddin, then Executive Director/ Chief Financial Officer is available here, http://www.malaysiaairlinesblog.com/pt/blog/default.aspx?id=444&t=MAS-Adoption-of-FRS139-pushes-agenda-for.

Thank you.

Tan Wai Fong

Head, Media Relations

Malaysia Airlines

Post a Comment