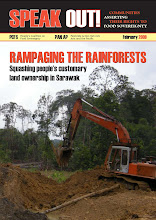

| While you are Sleeping, your Pensions & Retirement Savings are Disappearing Fast |  |  |  |

| Posted by Vineeth Menon on Malaysia Today | |

| Sunday, 23 March 2008 | |

| On March 19, 2008 NST (written by Zaidi Isham Ismail) reported EPF had obtained the Ministry of Finance's approval to invest USD 2 billion or RM 6.36 billion (RM 3.18 = USD 1). 1. As everyone should know, the new cabinet was sworn in after the report appeared on NST. How can a caretaker Minister of Finance have the legal authority to make such a decision for EPF to invest overseas another USD 2 billion?

2. In April 2005 when the Malaysian Central Bank announced liberalization, EPF invested USD 1 billion or RM 3.80 billion (at that time RM 3.80=USD 1) overseas, what happened to this pension money? Today that money is worth RM3.18b not RM3.8b or a RM 620 million losses unless EPF hedged this money via some futures forex contract.

3. In the same report, EPF reported that it has approval for USD 6 billion. How much foreign exchange losses??? 4. The NST report says 2006's assets (RM259.9b) grew 10% to RM285.9b in 2007 to provide a dividend of 5.8%. Assets are expected to grow by 21%, year-on-year, to RM346b in 2008 to keep the same dividend rate. Simple math does not add up! 5. Today the Dow Jones has fallen to around 12000 from 15000. So have nearly all the bourses in the world with few exceptions like Brazil. It is fair then to assume that EPF's foreign investments are likely to receive a double whammy – foreign exchange losses and intrinsic losses as well.

6. Obviously, EPF accountholders are kept in the dark. Could these funds be invested in collusion secretly with fund management companies appointed by EPF like Nomura (with massive sub-prime losses and was fined for securities fraud) and some proceeds to certain individuals with creative accounting techniques? The Beginning of this Sordid Mess – The Evidence 1. In April 2005 when Malaysia Central Bank announced liberalization, Pension funds, EPF and unit trusts could invest overseas. 2. In 2005 KWAP (Kumpulan Wang Amanah Pencen – Civil Servants Pension Fund) had a tough time finding a solicitor who had expertise to vet for an International Private Equity Agreement and make necessary changes. Their panel interviewed 30 to 40 legal firms. They finally awarded this contract to vet to Messrs H.M.J. Shaharom & K.S. Wee. Even the fees were agreed upon. 3. However upon completion, KWAP were in for a surprise as the amended vetted agreement pertaining to exceptional clauses and irregularities was rejected by the mandarins at KWAP. Legal work was done regardless upon agreed principles. The law firm sued for legal fees and won an order (was obtained) but KWAP used delaying tactics by changing law firms from Zainal Abidin & Co to Shook Lin & Bok. Case drag to May and June 2008. This whole thing is under the purview of the Minister of Finance. It is believed the present Chief Secretary had no knowledge of this court case. 4. Was this investment again safe and was there any instrument to safeguard the USD depreciation? In 2005 at RM 3.80 to the dollar, the original USD 30m investment would be equivalent to RM 114m. However, at current rates that USD 30m would amount to less than RM 96m only resulting in a whopping RM 18 million translation loss in investment belonging to KWAP. Other related questionable charges and fees highlighted were not adhered to. Instead the International Private Equity went ahead in original unvetted or forensic taxed form. 5. None of these appeared in the mainstream media. Copies of these public documents may be downloaded here (about 30MB): HERE |

No comments:

Post a Comment