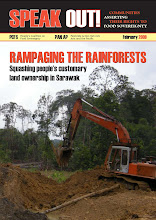

SPG SPEAKS

Selling

off Sarawak’s Oil & Gas Assets – Myth or Reality? How does Sarawak Benefit?

This paper reviews the recent report on Petronas seeking

to sell a stake in the SK316 PSC and questions what Sarawak is or should be doing

about it.

The news

Reuters

on 20th Feb 2017 reported in Singapore that Petronas is aiming to

sell its 49% stake in the SK316 offshore gas block in Malaysia’s Sarawak for up

to $1 billion seeking to raise cash and cut development costs. According to its

sources, Petronas is said to be working with an investment bank on the stake

sale and the process was kicked off in February 2017.[1]

On

21st Feb 2017, The Star reported that Datuk Wan Zulkiflee Wan

Ariffin, Petronas President and CEO denied the report that it was considering

selling its stake in the SK316 offshore gas block in Sarawak to raise cash,

adding that Petronas had a cash balance of RM130bil and that there was no need

to sell to get money.[2]

Block

SK316, located approximately 180 km North of Bintulu, Sarawak, is operated by

Petronas and contains a number of gas fields including the NC3 field which

feeds Malaysia's liquefied natural gas (LNG) export project, known as MLNG

Train 9.

In

2011 & 2012, Petronas reported that Kasawari-1 and NC8SW-1 were the latest

wells drilled in Block SK316 and were significant gas discoveries. The Kasawari

field had over five trillion standard cubic feet (TSCF) with an estimated

recoverable hydrocarbon resource of just over three TSCF, making it one of the

largest non-associated gas fields in Malaysia. The recoverable resource for the

NC8SW field is estimated at more than 450 billion standard cubic feet of gas.

In

late 2015, Petronas called off the tender for the Kasawari field development, a

contract worth over US$ 1 billion that had been offered earlier. The first gas

for Kasawari was initially targeted for late 2018, which is now delayed.

According

to the same Reuters’ sources, the stake to be sold is expected to include a

combination of the producing NC3 gas field, the potential development of the

Kasawari field and other exploration acreages in the block. The funds raised

could also contribute to the future development of the Kasawari field.

The reality

As

far as reported in the public domain, Block SK316 is still 100% held by

Petronas Carigali. While in the early 2011/12, Petronas was optimistic that it

could go on its own with the development of its gas discoveries in SK316

including the over US$ 1 billion required for the Kasawari development. Things

started to turn south in 2015, and with the falling oil prices and dwindling

cash flows added to both the increasingly technical and project development

challenges for Kasawari, Petronas decided to put the project on hold.

Fast

forward to 2017, where many believe that the Oil & Gas industry has reached

its bottom and is now back on the upward trend, with time being right for Oil

& Gas asset owners to evaluate their portfolio of assets in order to

extract their maximum value. In this case, Petronas should not be exempted in

assessing its portfolio of assets and identifying those that could be ‘flipped’

wholly or partially in return for cash or asset swaps or both. In the case of the

SK316 block, where there exist producing fields, development projects and

exploration options, selling a minority stake or farming out part of the PSC to

others appears indeed to be an interesting option.

However,

as SK316 is a gas PSC and having the NC3 field already feeding LNG Train 9,

added with the technical challenges of the Kasawari filed, it is expected that

there will be limited candidates for the minority stake in SK316. Nevertheless,

since NC3 is already producing, it becomes an interesting option for the

existing partners in LNG Train 9 in the likes of JX Nippon Oil & Energy or

parties with downstream interest in Bintulu to consider the upstream options.

Another

interesting aspect for the minority stake in SK316 is that as Petronas will

continue to be the operator, the stake is easily ‘bankable’ as the buyer can be

a non-technical party, opening the door for pure financial investors. This is,

however, subject to Petronas’ approval.

The possibilities

Putting

aside the argument of whether Petronas is selling off Sarawak’s Oil & Gas

resources or whether it has the right to do so by seeking investments for a minority

stake in SK316, there indeed exists the potential for the State of Sarawak (or

through one of its vehicles) to consider having the minority stake in the

upstream PSC.

This

has to be done through proper Oil & Gas due diligence process including examination

of both technical and financial aspects of the PSC.

However,

the more intriguing question remains whether the State of Sarawak is content to

continue to be mere spectator, or wants to become an active participant in the

development of the Oil & Gas resources of Sarawak.

“Mun

minyak ngan gas ya di Semenanjung nun sik aku ambik peduli. Tapi mun di Sarawak

aku ngambik peduli” Allahyarham

Tok Nan.

The

present Chief Minister Datuk Amar Abang Johari Tun Openg says Sarawakians must

decide their own destiny, not to have somebody else deciding for them.

Thus,

the State Government of the day must create policies that are Sarawak-centric

and focused on the immediate and strategic needs of the State, he said.

“So

we are left in a situation where we have oil and gas and cannot fully enjoy the

benefit of having oil and gas. This cannot be…“

He

said it is therefore of strategic importance that Sarawak should try to use as

much as possible of its energy resources for its own economic development and

industrialization.

The

‘recycled’ news about Petronas’ intent to divest 49% of its stake in SK316

offshore Sarawak is making the rounds again in the local news recently. It was

first reported in February 2017 and was quickly denied by Petronas. In April,

the Reuters report again resurfaced.

To

the Oil & Gas industry observers, the news is a positive one as it improves

the outlook delayed Kasawari gas project. BMI Research was upbeat on the potential sale of

equity as the bulk of the funds generated from the stake sale in the SK316

offshore gas block is expected to be used to develop the Kasawari field.

The Kasawari gas project, which is part of SK316, is a

deepwater, sour gas development estimated to hold about 3.2 trillion cubic feet

of recoverable gas resources.

“Despite promising below-ground prospects, development

has progressed slowly due to the field’s deepwater, high-cost structure, and

the relative inexperience of domestic engineering firms involving carbon

dioxide removal. Potential integration of a foreign partner could dilute the

project’s cost burden. Any future gas output from Kasawari will likely be

designated for exports, given Malaysia’s comfortable surplus in gas,” the

research house said in a statement.

We believe that Petronas’ search for potential foreign

partner in the project is not unreasonable.

Saya Peduli

However, the news of the proposed sale is indeed a

sour note for Sarawakians. Echoing the words of the late Tok Nan, any proposed

‘sale’ of Sarawak Oil & Gas assets by the party that was supposed to have

the ‘vested interest’ of Sarawak in mind without the apparent knowledge of the

government and people of Sarawak shows the ‘tidak peduli’ attitude of the

parties involved.

Nevertheless, instead of dwelling in the negatives,

SPG would like to propose that in the period where devolution of authorities

and negotiations on Oil & Gas rights are taking place between the State and

Federal government, a Joint Oil & Gas Development Authority (JOGDA) be

created comprising the Federal government, the State government and Petronas

where all strategic matters concerning Sarawak’s Oil & Gas matters,

including new PSC awards, sale or transfer of interests, are deliberated.

SPG will lend its expertise to assist and support the

government of Sarawak in the setting up of JOGDA in the spirit of ‘Saya Peduli’

in maximizing Sarawak’s

socio-economic benefit and safeguarding its rights in the O&G industry for

its present and future generations.

Until

and unless Sarawak takes decisive action, we remain at the mercy of others.

5 comments:

Nama: __ Hendi Zikri Didi

Kota: _______________ Malacca

pekerjaan: _ Pemilik bisnis

Setiap pemberitahuan: ____ hendidi01@gmail.com

Halo semua, harap berhati-hati tentang mendapatkan pinjaman di sini, saya telah bertemu banyak pemberi pinjaman palsu di internet, saya tipuan saya hampir menyerah, sampai saya bertemu seorang teman yang baru saja mengajukan pinjaman dan dia mendapat pinjaman tanpa stres, jadi dia memperkenalkan saya pada PERUSAHAAN PINJAMAN AASIMAHA ADILA AASIMAHA ADILA yang sah, saya melamar Rm1, 3 juta. Saya memiliki pinjaman dalam waktu kurang dari 2 jam hanya dalam 1% tanpa jaminan. Saya sangat senang karena saya diselamatkan dari menjadi miskin dengan hutang. jadi saya menyarankan semua orang di sini membutuhkan pinjaman untuk menghubungi AASIMAHA dan saya meyakinkan Anda bahwa Anda akan mendapatkan pinjaman Anda.

Aplikasi / Pusat Kontak

E-mail: ._________ aasimahaadilaahmed.loanfirm@gmail.com

WhatsApp ____________________ + 447723553516

e_mail:[iskandalestari.kreditpersatuan@gmail.com]

WhatsApp Number::::::::::[+60]1123759663

Telephone..Number:[+60]1123759663

email:::::::hafizulbin365@gmail.com

Name::::Hafizul Bin Haziq

Country:::Malaysia

Kemarau kewangan saya berakhir pada bulan ini apabila saya fikir semuanya adalah urusan perniagaan dengan beberapa rakan saya di Kuala Lumpur beberapa bulan yang lalu perniagaan yang bernilai beberapa Rm785.000.00 yang keuntungannya sudah cukup untuk kita semua untuk berkongsi keuntungan tetapi akibat kegagalan perniagaan, kita semua mendapati bahawa kita mempunyai masalah kewangan yang sangat besar kerana saya tidak mempunyai wang untuk bergantung pada ketika perniagaan gagal kerana saya melabur semua saya dengan saya pada perniagaan jadi saya berada di sangat sangat maaf jadi saya terpaksa mencari bantuan kewangan saya sebenarnya telah ditolak oleh beberapa bank sebagai hasil dari kadar pinjaman mereka dan juga syarat mereka jadi saya terpaksa melalui beberapa blog sehingga saya datang menghadapi dengan Iklan Syarikat Ibu. saya menghubungi Ibu dengan segera selepas melalui beberapa proses yang sangat fleksibel permintaan pinjaman saya sebanyak Rm440.000.00 telah diluluskan oleh pihak pengurusan dan pada keesokannya Lembaga Pengurusan Peminjaman Pinjaman dikreditkan saya tanpa menangguhkan berkat ini dari ibu yang dapat menyelamatkan anda hari ini dari apa-apa embarrazement kewangan anda menjadi ibu hubungi Ibu sekarang untuk pinjaman anda yang berubah e_mail:[iskandalestari.kreditpersatuan@gmail.com]

ISKANDAR LESTARI LOAN COMPANY "ISKANDAR LENDERS"

Country::::::Malaysia

Name::::::::Hafizul Bin Haziq

email::hafizulbin365@gmail.com

Telephone Number:[+60]1123759663

WhatsApp Number::::::::[+60]1123759663

e_mail:[iskandalestari.kreditpersatuan@gmail.com]

Salam untuk kalian semua. Nama saya Agus Santoso, saya ingin menggunakan media ini untuk mengingatkan para pencari pinjaman agar berhati-hati, karena banyak sekali penipuan di mana-mana, mereka akan mengirimkan dokumen perjanjian palsu kepada Anda dan berjanji ini dan itu, para penganggur, saya sarankan Anda semua memiliki untuk berhati-hati

Beberapa bulan yang lalu, saya mengalami kesulitan keuangan dan sangat membutuhkan pinjaman untuk mendapatkan kembali bisnis saya, saya mengajukan pinjaman 250 juta. Saya tertipu oleh beberapa pemberi pinjaman online. Saya mengalami lebih banyak kesulitan keuangan karena saya meminjam untuk membayar sebagian biaya setelah menghabiskan dana saya. Saya hampir kehilangan harapan sampai ALLAH menggunakan teman saya untuk merujuk saya ke pemberi pinjaman yang sangat andal bernama Helen Wilson, seorang ibu yang luar biasa, yang meminjamkan saya pinjaman 250 juta tanpa jaminan dalam waktu 24 jam tanpa tekanan pada tingkat bunga 2%.

Saya terkejut ketika saya memeriksa saldo rekening bank saya dan menemukan bahwa jumlah yang saya ajukan telah dicairkan langsung ke rekening bank saya tanpa penundaan.

Karena saya berjanji akan membagikan kabar baik agar masyarakat bisa mendapatkan pinjaman dengan mudah tanpa stres. Jadi jika Anda membutuhkan pinjaman, silakan hubungi ibu yang baik melalui email: helenwilson719@gmail.com

dan dengan rahmat Allah dia tidak akan mengecewakan. jika Anda mematuhi perintah-perintahnya.

Anda juga dapat menghubungi saya di email saya: agsantoso576@gmail.com

dan teman saya yang memperkenalkan saya dan bercerita tentang Bu Helen Wilson, dia juga mendapat pinjaman baru dari Bu Helen Wilson, Anda juga dapat menghubungi dia melalui email: (wahyusaptohandoko256@gmail.com) sekarang,

Yang akan saya lakukan adalah berusaha memenuhi pembayaran pinjaman bulanan saya. Anda masih bisa mengobrol, ibu yang baik, Nomor WhatsApp; +1-585-326-2165

mohon bijak dan semoga Allah membimbing kita semua

Nama saya Agus Santoso

Pinjaman saya 250 juta

KEUANGAN WEMA

email: helenwilson719@gmail.com

WA: +1-585-326-2165

Waalaikumsalam Warahmatullahi Wabarakatuh

Are you in a financial crisis, looking for money to start your own business or to pay your bills?

GET YOUR BLANK ATM CREDIT CARD AT AFFORDABLE PRICE*

We sell this cards to all our customers and interested buyers

worldwide,Tho card has a daily withdrawal limit of $5000 and up to $50,000

spending limit in stores and unlimited on POS.

YOU CAN ALSO MAKE BINARY INVESTMENTS WITH LITTLE AS $500 AND GET $10,000 JUST IN SEVEN DAYS

email blankatmmasterusa@gmail.com

you can also call or whatsapp us Contact us today for more enlightenment *

+1(539) 888-2243*

WE ARE REAL AND LEGIT...........2019 FUNDS/FORGET ABOUT GETTING A LOAN..*

WHATSAPP CONTACT======>>>> +1(539) 888-2243

IT HAS BEEN TESTED AND TRUSTED

Borrow money here today at 3% interest rate. Sawda Capital Finance offers all kinds of financial services of all sizes ranging from individuals, companies, and traders globally./Our services are 100% guaranteed and risk-free.

We build just the right financing for each client, with simple paperwork, quick approvals, and flexible payment schedules. For further details, Kindly contact us via email At sawda.finance@gmail.com

Intermediaries/Consultants/Brokers are welcome to bring their clients and are 100% protected. In complete confidence, we will work together for the benefits of all parties involved, Looking forward to rendering the best of our services to all esteemed clientele globally.

Post a Comment