Reproduced with permission

Playing Games With Names — Jho Low’s Modus Operandi

The

Auditor General, who is known for his upright approach, is going to

have a hard time re-setting a date for the publication of his report

into 1MDB — due today, but postponed till further notice.

Like

the Attorney General, Deputy Prime Minister, Head of the Public

Accounts Committee, Vice President for UMNO, Special Branch Chief and

shortly the Head of the Central Bank, he may find himself replaced

first. At least he is still alive, unlike the investigator from the MACC

into this dirty business, Kevin Morais

.

Today’s report

in the Wall Street Journal shows that 1MDB paid a total of US$850

million into a bogus off-shore company, using the name of the Abu Dhabi

fund Aabar, Aabar Investments PJS Ltd.

It follows on from our own expose

earlier this week detailing that, contrary to claims by 1MDB, the

Seychelles company Good Star Limited belongs entirely to Jho Low, which

confirms that the Prime Minister’s nominee was running 1MDB’s operations

and indeed running off with a great deal of the money.

The

revelation also confirms a pattern that has provided unmistakable

evidence of a ‘modus operandi’ by the youthful Official Advisor to 1MDB,

which was the title given to Low. We can point to numerous transactions

involving Jho Low and his nightclubbing friend, Aabar’s Khadam Al

Qubaisi, which essentially consist of playing games with names to give

the impression that shadowy off-shore companies were some sort of

subsidiary of major concerns.

These companies have all turned out to be linked to suspicious losses of money from 1MDB.

PetroSaudi International Limited (Seychelles)

Take

PetroSaudi International Limited, Seychelles, which was positioned as a

subsidiary to PetroSaudi Holdings Limited (Cayman) which was involved

in the joint venture with 1MDB. In fact (after considerable to-ing and

fro-ing about how to set up the arrangement) it was a company totally

controlled by Jho Low through an investment management deal with one of

his own off-shore companies Panama Investment Manager, which gave him

control over all its money.

Tarek

Obaid had agreed to act as the Director of PetroSaudi International,

but in a personal capacity, not linked to the main joint venture partner

as alleged.

During

its buy out of UBG, orchestrated by Jho Low, who had a major personal

stake in the company, there was much concern expressed by AmBank

officials negotiating the deal about who exactly did own this supposed

off-shoot of PetroSaudi (which had received the money used to buy UBG

from 1MDB).

They

were told that the shady nature of the ownership was owning to the need

to conceal the private interest of the King of Saudi Arabia in the

deal! They accepted the excuse, which was a lie.

SRC Global

In

2013 the Aabar owned Spanish oil giant CEPSA purchased the Canadian

company Coastal Energy for US$2.3 billion, in a deal masterminded of

course by their boss the then all-powerful Chairman Khadem Al Qubaisi.

Strangely,

he did the deal in tandem with a private company owned by none other

than Jho Low, which took an option on the sale in its alleged role as

‘facilitator’. That company of Jho Low’s went by the name of Strategic Resources Global.

The details of SRG’s involvement have yet to be published, however

insiders have intimated that the point of the option was that it could

then be valuably sold back to CEPSA.

Given

Low’s established history of using 1MDB money as backing for other

private deals forged together with his pal Khadem from Aabar (see our

exposes on the London Hotel bids of 2011) there can only be questions asked as to the strikingly similar name of the 1MDB subsidiary SRC International Sdn Bhd.

The

shadowy nature of SRC International has caused constant comment in

Malaysia, set up as it was with RM4 billion borrowed from the public

pension fund KWAP, which has never been properly accounted for. One of

its known ventures however (through a BVI vehicle naturally) was a joint

venture with none other than that sturdy business partner Aabar and

KAQ, named none other than Aabar-SRC Strategic Resources Ltd.

Was

name play once again at work as money flushed through these off-shore

concerns with such similar names and confusion of cross-ownerships? Did,

by any chance, money flow in this fashion from the pension fund through

1MDB and its joint ventures with Aabar and into a private deal between

Jho Low and Khadem?

We

cannot know, because when questioned on these matters, the Finance

Minister (cum Prime Minister, cum sole shareholder of 1MDB) hived SRC

off from 1MDB and put it under his own Ministry of Finance portfolio,

from where he has refused to release transparent accounts ever since.

The public money remains unaccounted for!

Merryl Capital

Move on to what the Australian newspaper

describes as the mysterious off-shore company Merryl Capital, which was

stuck right in the middle of the unravelling scandal in Australia over

the finance company Bridge Global, which Najib (doubtless on the advice

of 1MDB’s advisor Jho Low) used to invest the alleged profits (obtained

not in cash, but in ‘promissory notes’ mind you) made from the

PetroSaudi deal, from which Good Star had siphoned most of 1MDB’s

original investment.

As the Australian points out, despite its name, this entity has nothing to do with the more famous Merryl Lynch.

Bridge Partners didn’t pay in cash but in promissory notes — IOUs — which 1MDB then invested in Bridge Global Absolute Return. According to Bridge Global’s prospectus, Bridge Global Absolute Return is managed by Hanhong, a Hong Kong securities company in which it planned to buy a half stake.

Bridge Global Absolute Return owns almost 10 per cent of Bridge Global, making it the company’s second-biggest shareholder behind another mysterious offshore entity, Merrill Capital, which owns 10.2 per cent.

Despite its name, Merrill Capital appears not to be linked to Merrill Lynch, according to Mr Childs’ affidavit. It is instead a UAE company associated with Mr Goh that owns some 8.5 per cent of Avestra.

To cover the Petrosaudi hole, it’s alleged that in 2012 1MDB signed a deal with Abu Dhabi’s International Petroleum Investment Corporation under which IPIC guaranteed $US3.5bn of bonds issued by 1MDB.

Aabar Investments PJS Ltd

So,

it looks like we have an established modus operandi indeed when it

comes to the way Jho Low played David Copperfield conjuring tricks with

1MDB’s money, as it slipped away from the public fund that was being

administered by his boss the PM, and into companies with names designed

to make them sound like a more reputable outfit linked to established

1MDB deals.

The

latest revelation that US$850 million was likewise transferred to Aabar

Investments PJS Ltd by 1MDB thus follows an established pattern. The

WSJ have reported that Aabar has confirmed that this off-shore BVI

entity, which was opened to take the money and then closed down agains

shortly after, has nothing to do with their own group.

Abu

Dhabi have, of course, long since sacked Khadem Al Qubaisi, after all

these irregularities came to light at the start of the year. Yet,

Malaysia’s PM continues to defend 1MDB and Jho Low and he is obstructing

vigorously the attempts to investigate what went wrong with all that

missing money.

Other

off-shore companies with surprisingly similar names to more reputable

firms doubtless wait to be discovered and the 1MDB scandal continues to

inevitably unravel in the face of the international investigations

underway.

READ the full story by Wall Street Journal below:

People passing a 1Malaysia Development Bhd. billboard in Kuala Lumpur, Malaysia, in March. PHOTO: REUTERS

Malaysia’s 1MDB Sent $850 Million to Entity Set Up to Appear Owned by Abu Dhabi Wealth Fund

A

troubled Malaysian state investment fund sent at least $850 million

last year to an offshore entity set up to appear that it was owned by an

Abu Dhabi sovereign-wealth fund, a transfer which deepens the mystery

over billions of dollars that are unaccounted for, according to

documents reviewed by The Wall Street Journal and people familiar with

the matter.

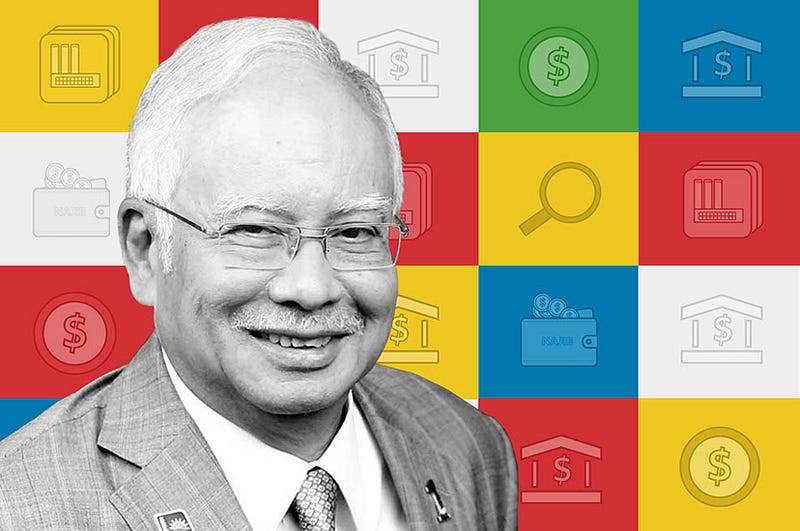

The

1Malaysia Development Bhd. fund, or 1MDB, set up by Malaysian Prime

Minister Najib Razak in 2009 to promote economic development, is under investigation

in at least six countries over a broad array of allegations that money

was siphoned off for political spending and for personal gain.

One

focus of investigation is $2.4 billion in payments that 1MDB said it

made to a unit of Abu Dhabi’s International Petroleum Investment Co., or

IPIC, as part of a deal involving the Malaysian fund’s purchase of

power plants. The Journal reported in September that IPIC officials had concluded they did not receive the money, according to people familiar with the matter.

A

1MDB unit transferred at least $850 million via three transactions last

year to a British Virgin Islands-registered company with a name that

made it look like it was controlled by IPIC, according to wire transfer

documents viewed by the Journal and two people familiar with the matter.

The

1MDB fund sent the money to “Aabar Investments PJS Ltd.” which closely

resembles the name of IPIC’s wholly owned subsidiary Aabar Investments

PJS, the wire documents show.

Aabar,

the IPIC subsidiary, is an Abu Dhabi-registered company that holds

prominent investments in the space tourism venture Virgin Galactic and a

5.1% stake in UniCredit SpA, Italy’s biggest bank.

Executives

at IPIC and Aabar investigating the transfers have concluded neither of

the two Abu Dhabi funds ever owned or controlled the British Virgin

Islands company, according to the people familiar with the matter.

Records in the British Virgin Islands don’t give any details on the

owners or directors of the company.

The

records show the British Virgin Islands firm was incorporated on March

14, 2012, and liquidated on June 23 this year, a time of growing

criticism of 1MDB from opposition politicians and within Mr. Najib’s

ruling party.

The

1MDB fund, in a statement to the Journal after publication of this

article, did not reply to questions previously submitted about the

transfers. The statement said “that the Wall Street Journal continues

its campaign to malign 1MDB.” The fund also said it was cooperating with

investigators. 1MDB in the past has said it stands by its financial

statements, which show it made the payments to the Abu Dhabi fund.

An

IPIC spokesman did not respond to questions. The Abu Dhabi fund hasn’t

made any public statements about its relationship with 1MDB or the

missing money.

Mr.

Najib promised the fund would spur economic development by investing in

new industries like renewable energy. But it has only bought existing

power plants and land, while rolling up over $11 billion in debt that it is struggling to repay.

The

transfers involving Abu Dhabi are among a series of transactions by

1MDB that are the focus of investigations. In Malaysia, the fund is

being probed by the auditor general, the nation’s anticorruption body,

the central bank and a parliamentary committee.

In

2012, 1MDB issued $3.5 billion in bonds to fund the purchase of power

plants in Malaysia and overseas. The Abu Dhabi fund guaranteed the

bonds.

The

1MDB fund’s publicly-available financial statements for the year ending

March 31, 2013, show it paid $1.4 billion to IPIC’s unit Aabar as

collateral for guaranteeing the bonds. The Malaysian fund said it paid

another $993 million to Aabar in 2014 to cancel options granted to IPIC

to buy a stake in 1MDB’s power assets, according to a copy of a draft

report into 1MDB by Malaysia’s auditor general and 1MDB board minutes

reviewed by the Journal.

Officials

at IPIC say neither they nor any subsidiary received this money, the

Journal reported. It is not clear why the payments were made to Aabar

since IPIC made the guarantee.

IPIC’s

consolidated financial statements, which include Aabar, make no

reference to the collateral payment. A footnote in the 2014 statements

said that as of the end of that year 1MDB owed IPIC $481.3 million in

outstanding payments for the options.

No

substantial amount of money was received by IPIC, the people familiar

with the matter said. It isn’t clear how IPIC arrived at the $481.3

million figure and whether it relates to the $993 million transfer 1MDB

says it made to IPIC as partial payment to cancel the options.

IPIC’s

former managing director, Khadem Al Qubaisi, was dismissed in April by a

presidential decree. The new management team of IPIC has been

scrutinizing Mr. Al Qubaisi’s activity at the fund, according to the

people familiar with the matter.

The latest twist in the 1MDB saga comes as Mr. Najib battles a separate scandal linked to the fund. Malaysian investigators said earlier this year

that nearly $700 million was transferred into his personal bank

accounts through entities linked to 1MDB, including a private Swiss bank

owned by IPIC.

The

source of the funds was unclear and the government investigation didn’t

detail what happened to the money that allegedly went into Mr. Najib’s

accounts.

Malaysia’s anticorruption body in August said the funds were a donation from the Middle East. The donor wasn’t specified.

Mr.

Najib has denied wrongdoing and said he didn’t use any money for

personal gain. He said this month that using money from a donor was

appropriate and legal.

As well as Malaysia and Abu Dhabi, authorities in the U.S., Switzerland, Singapore, and Hong Kong are looking at 1MDB’s activities.

— Nicolas Parasie and Yantoultra Ngui contributed to this article.

Write to Bradley Hope at [email protected]

Originally published at www.sarawakreport.org.

No comments:

Post a Comment