Sarawak Report awaits 1MDB Arul Kanda’s suit for libel over our allegedly ‘unsubstantiated’ reports.

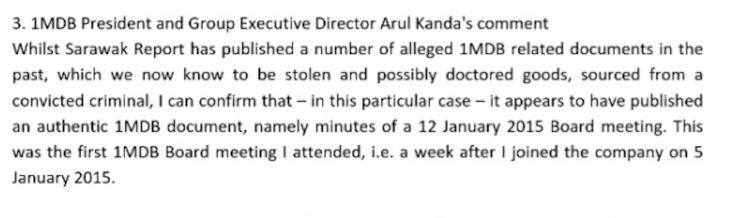

In his latest press release

he claims that our PetroSaudi evidence is ‘unfounded’ and ‘possibly

doctored’, while admitting that our copies of 1MDB Board minutes were

accurate.

Forced to admit to the 1MDB minutes, but still claiming our PetroSaudi documents are ‘unfounded’ and possibly doctored?!

If

any of the documents which we have produced about the joint venture

deal between 1MDB and PetroSaudi are “possibly doctored” as he ventures

to suggest, it would, of course, be the easiest thing in the world for

Mr Kanda to produce the evidence from his own records and explain the

truth to a UK court.

Likewise,

if our allegations were “unfounded”, why has the only remaining

institution in Malaysia that retains a shred of credibility in the eyes

of the world, Bank Negara Malaysia, backed our findings down to the very

last dollar?

We

have detailed how US$1 billion + US$500 million + US$330 million (=

US$1.83 billion) were channelled from 1MDB into a fraudulent deal with

PetroSaudi, where most of the money was diverted into the Zurich account

of the company Good Star Limited belonging to its official ‘Advisor’

Jho Low.

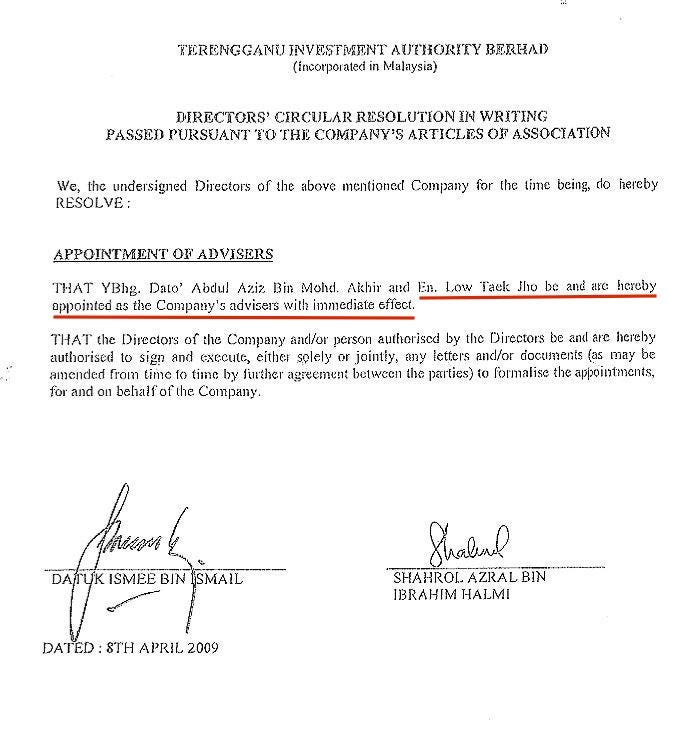

See

for the first time the document (which Mr Kanda is welcome to dispute)

that proves the official nature of Jho Low’s role at the Terengganu/1MDB Development Fund, which he has so emphatically denied for so long:

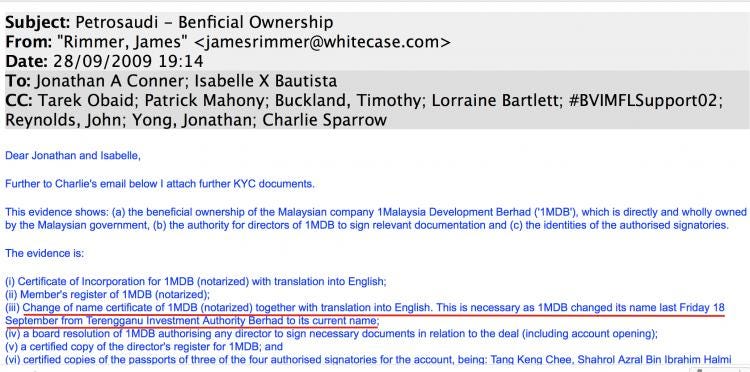

The

Terengganu Investment Authority changed its name to 1MDB half way

through the Petro-Saudi deal on September 18th 2009, which Jho Low

managed from beginning to end, despite his repeated claims that he had

nothing to do with 1MDB after May 2009.

PetroSaudi’s lawyer from White & Case noted the date in an email (which Mr Kanda is welcome to dispute)

Last

week, of course, Bank Negara confirmed our findings on the purloined

US$1.83 billion by demanding this exact sum of money back and baldly

stating that it had recommended criminal proceedings against 1MDB for allowing the PetroSaudi scam to proceed:

“The Bank concluded that permissions required under the ECA [Exchange Control Act] for 1MDB’s investments abroad were obtained based on inaccurate or without complete disclosure of material information relevant to the Bank’s assessment of 1MDB’s applications.

Therefore, the Bank has revoked three permissions granted to 1MDB under the ECA for investments abroad totalling USD1.83 billion and also issued a direction under the Financial Services Act 2013 to 1MDB to repatriate the amount of USD1.83 billion to Malaysia and submit a plan to the Bank for this purpose”.[Bank Negara Statement]

Despite

this plain speaking by Bank Negara, Arul Kanda still attempts to say

that our allegations are “unfounded” and that our evidence is “possibly

doctored” — whilst not suing us.

He

also refers to one our several cross-referenced sources as a “convicted

criminal”, whilst conveniently neglecting to mention that this Swiss

national, Xavier Justo, was a former senior director of 1MDB’s own joint

venture partner PetroSaudi and that he was convicted (in Thailand) for

attempting to blackmail his fellow PetroSaudi directors, using evidence

about their role in the 1MDB billion dollar scam.

Mr

Arul Kanda is welcome to sue Sarawak Report on the basis that Justo was

convicted of blackmail using a trove of fictitious evidence that just

happens to tie up with a mass of other proven information from numerous

other sources.

Meanwhile,

we are are happy to concur with the opposition MP Tony Pua that Kanda,

through his string of conflicting statements and changing stories, has

proved himself to be a serial, if highly unconvincing, liar.

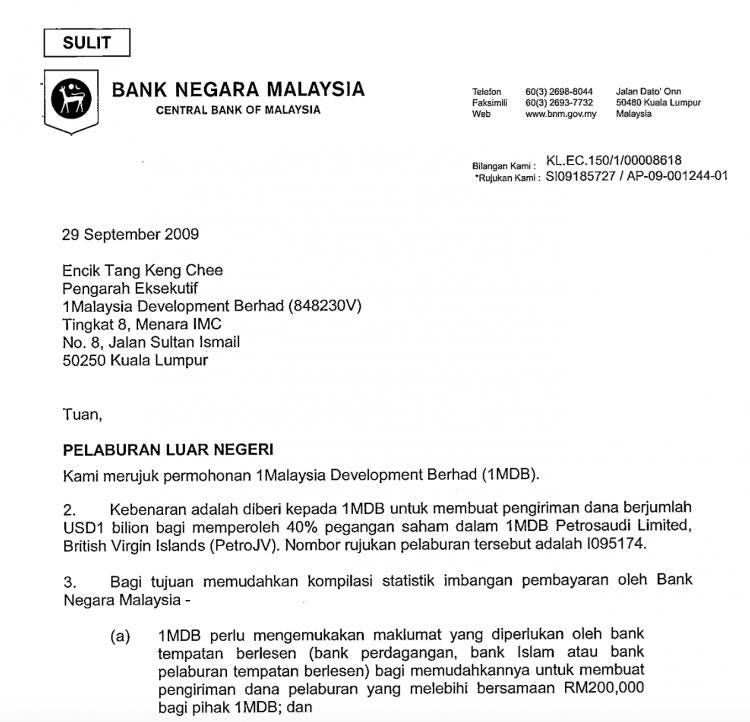

How 1MDB Cheated Bank Negara

Through

PetroSaudi’s own emails Sarawak Report has obtained the Letter of

Permission from Bank Negara to 1MDB’s initial request to export a

billion dollars into the alleged joint venture in September 2009.

PetroSaudi,

1MDB and Bank Negara are welcome to contest the authenticity of this

and other documents, which we are now releasing.

Meanwhile,

we suggest that this letter shows exactly why the bank is now saying

that it was seriously and deliberately mislead by 1MDB and why it is

demanding the money back and wants to issue criminal proceedings.

The letter was originally written in Malay, then PetroSaudi received a certified English translation.

If

our reproduction here has been “tampered” or “doctored” in any way,

then of course anyone from the Bank Negara, 1MDB or PetroSaudi itself

will be very well-placed to sue Sarawak Report for misrepresentation and

publish the correct version in the meantime:

[For the full Malay and English versions of the BNM letter see the base of this story].

This

letter of authorisation, which was sent by the Director of the Foreign

Exchange Administration Department to 1MDB’s then Executive Director, Mr

Tang Keng Chee, grants permission for the payment of the initial US$1

billion on the basis that amongst other provisions:

“PetroJV will utilize the equity funds totaling USD 2.5 billion from its shareholders to fund the investment in the energy, agriculture, real estate and tourism sectors in Malaysia and overseas;

The said funds in the sum of USD 2.5 billion will be placed in PetroJV’s account with Banca della Svizzera Italiana SA, Geneva pending investments in future projects;

In

other words, the letter makes plain that BMN was of the clear

understanding that 1MDB was providing 40% of a cash injection into a

joint fund, which would be combined with a US$1.5 billion cash investment by PetroSaudi, designed to fund a variety of projects, including investments in Malaysia.

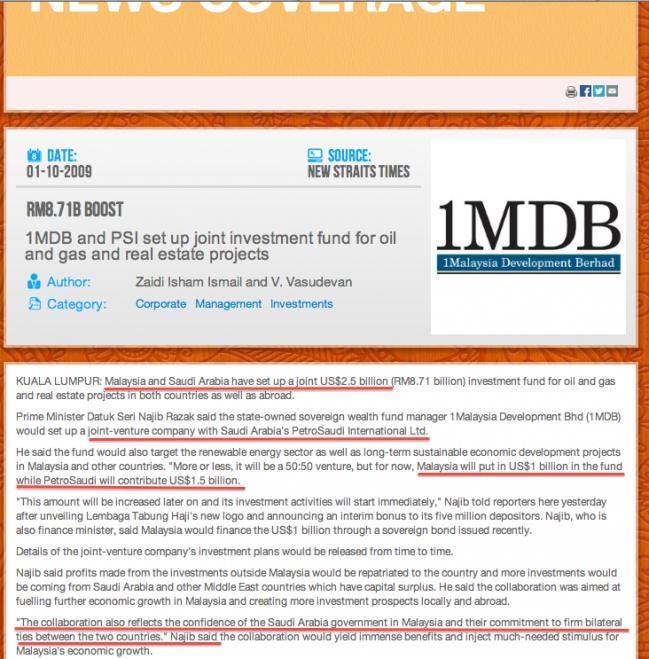

That understanding reflected 1MDB’s own press releases of the time (since noticeably removed from its site):

As

is now known, PetroSaudi in the event contributed no cash to the deal

and the majority of the billion dollars injected by 1MDB was not paid

into the joint venture account, but into Jho Low’s own company Good

Star’s account at RBS Coutts in Zurich. Bank Negara Malaysia was

therefore misled, just like the public.

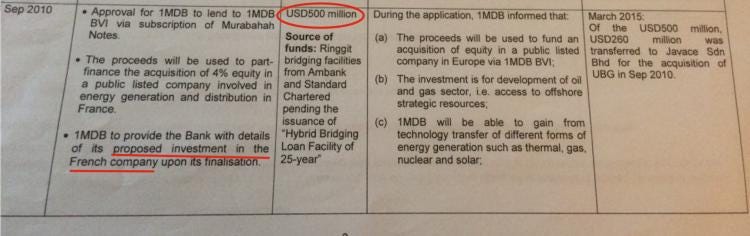

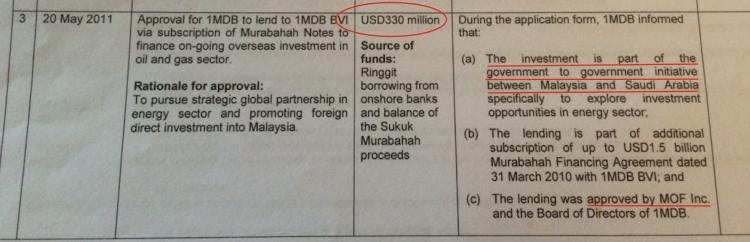

Investigation

documents produced by Bank Negara (below) show that repeated later

queries about how the money was being invested were ignored and put off

by 1MDB, which instead went on to borrow a further US$500 million and

US$330 million on similar false pretences, which likewise disappeared

mainly into Jho Low’s account at Good Star.

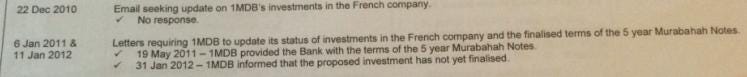

Bank

Negara’s investigation shows when it tried to follow up on the payments

they were given the brush-off by 1MDB or faced extraordinary delays and

partial responses.

It

is plainly for this reason that BMN wants all the 1MDB PetroSaudi money

returned and has requested for criminal proceedings to be opened. The

previous Attorney General Gani Patail had started drawing up charge

sheets for prosecutions related to 1MDB.

However, as Malaysia knows, Najib responded with an executive coup — he replaced the Head of Special Branch,

who then sent a team of officers to apprehend Gani Patail as he arrived

at his office on Monday 27th July. Patail was informed that he was to

retire immediately on ‘health grounds’ without entering his office to

collect his things.

It

is unconstitutional for the Prime Minister to fire an Attorney General

and it is unconstitutional for him to personally hand-pick a successor.

However,

this is exactly what Najib has done and new his hand-picked AG, Apandi

Ali, is now refusing to act upon Bank Negara’s recommendation to

prosecute 1MDB.

So,

when Arul Kanda continues to issue sanctimonious press releases saying

all is well with 1MDB and that Sarawak Report is ‘doctoring’ documents.

Is he relying on the facts or just the strong arm tactics of his boss?

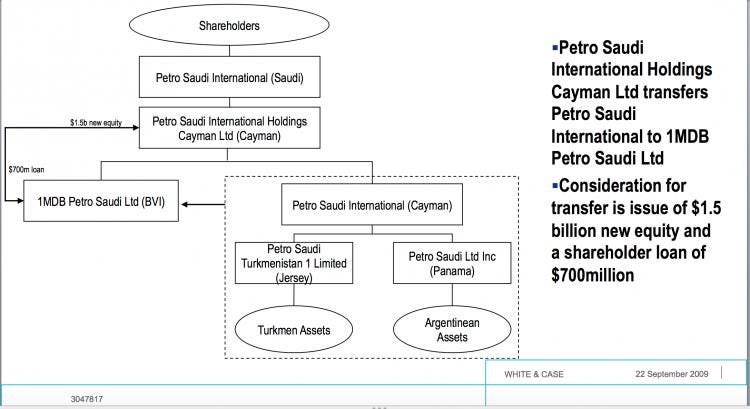

Fraudulent valuation of PetroSaudi

A

key element of the criminal case against 1MDB is the astonishing and

wilfully negligent failure of the board and directors of this public

company to obtain an independent valuation of its proposed joint venture

partner PetroSaudi, introduced by the PM’s appointed ‘advisor’ Jho Low.

Instead

of placing cash as advertised to BNM and the public into the so-called

joint venture, it emerged during the course of the two week lightening

negotiation period that PetroSaudi was merely injecting ‘assets’ in the

form of a subsidiary company (PetroSaudi International (Cayman) that

allegedly owned valuable oil concessions in Turkemenistan.

However,

PetroSaudi did not own the Turkmenistan oil field, it belonged to a

Canadian company called Buried Hill instead. Furthermore, the concession

was valueless to the extent that it is located in a disputed region of

the Caspian Sea, making it currently impossible to legalise the

ownership.

That

didn’t stop PetroSaudi claiming the ownership and issuing a fictitious

$700 million ‘shareholder loan’ as part of the supposed asset transfer

to the joint venture company, which two days later it would demand back

in hard cash!

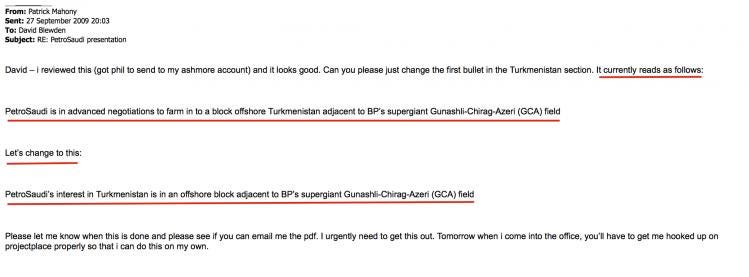

To

supposedly cover its obligations during the checking period on the deal

(conducted at lightening speed) the 1MDB Board, directed by Shahrol

Halmi, agreed to accept a valuation of this PetroSaudi International

(Cayman) subsidiary from an American banker, who was recommended by none

other than PetroSaudi Director Patrick Mahony himself, a banker called

Ed Morse.

Morse

was a prominent former politician and is currently Commodities Head of

Citigroup, but in 2009 he was out of work, having lost his job with

Lehman Brothers. He was also a close contact of Patrick Mahony and Tarek

Obaid and the men were in regular touch before and after the 1MDB deal.

It

was Mahony who hired Morse to value PetroSaudi International

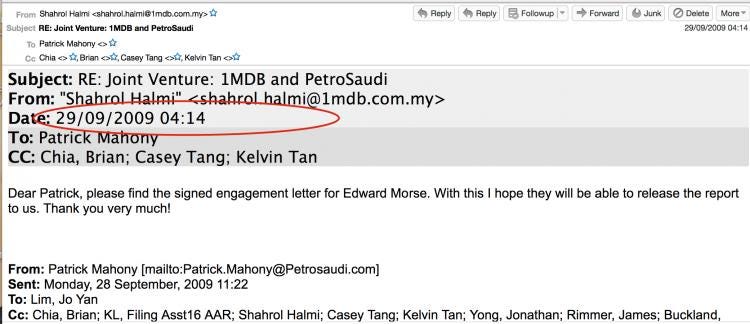

(Cayman) — he then passed it on to Shahrol Halmi as if it were an

independent valuation!

The

fact that this was only a window dressing exercise to please the

auditors is further made clear by the fact that the Malaysian end of

this dodgy deal only received Ed Morse’s document the day AFTER the deal

had already been signed on 29th September 2009.

Further correspondence shows that Morse derived all of his information for his “independent report” from a document sent to him by Mahony himself just before he wrote it up.

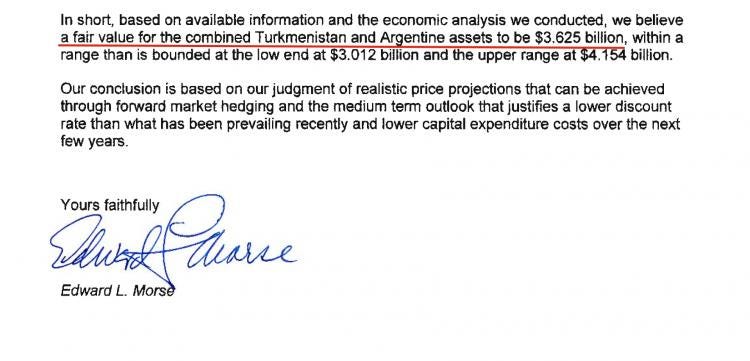

He admits as much in his own report:

“The analyses, opinions and conclusions presented in this report are based on our best economic judgments on the data that were made available to us by the managements of PetroSaudi International Limited and 1MDB PetroSaudi Limited” [Ed Morse report]

If

Morse had checked out any of the data provided by PetroSaudi, he would

have realised that they did not own the Turkmenistan oil field and that

an Argentine concession was mainly funded with borrowed funds. Instead

he summarised after the event:

Morse

was offered US$50,000 for this re-jigged version of PetroSaudi’s own

figures, which was in the event bumped up to double by Patrick Mahony,

presumably as a thanks for getting such a massive evaluation job done in

just two days!

Laughably,

the 1MDB Board and management accepted this so-called ‘injection of

assets’ purely in the form of the transfer of PetroSaudi’s subsidiary

company in the Caymans. There was no legal transfer of any genuine

ownership of that company’s supposed assets, for example the alleged

Turkmenistan oil concession.

Fraudulent transfer

As

if such blatant and wilful negligence by the Board and management of a

public company were not enough to prompt Bank Negara’s criminal case

against 1MDB, the matter of course gets worse.

Bank

Negara was specifically informed that all the US$1 billion being paid

into the PetroSaudi venture was going to the joint venture company

itself. Instead, the conspirators behind the deal injected a fictitious

US$700 million ‘shareholder’ paper ‘loan’ into the equation on the 25th

of September, just 3 days before the signing of the deal.

They

then requested the money be paid directly back to PetroSaudi by 1MDB in

cold hard cash on the day of the loan. This ‘repayment’ was dressed up

as a consideration for the huge extra value of the supposed assets of

the injected Cayman subsidiary, which Morse had put at US$3 billion, but

were actually fictitious, unchecked and legally unsecured.

It

gets worse, because of course as we all know the US$700 million did not

even get paid to PetroSauidi, it got paid directly to a company owned

by Jho Low called Good Star Limited, incorporated in the Seychelles.

There

is a mound of evidence to show that PetroSaudi, in particular Patrick

Mahony, deliberately lied to 1MDB on this point, claiming that Good Star

was a PetroSaudi subsidiary.

The

company has continued to make this claim and lie in recent weeks in

various statements seeking to imply that the money went to PetroSaudi

instead of Jho Low:

“In a statement to The New York Times this week, 1MDB said that Good Star was owned by PetroSaudi and noted that PetroSaudi had confirmed that 1MDB said it had provided information about these transactions to the Malaysian authorities that are investigating the sovereign fund.”[NYT 18/6/15]

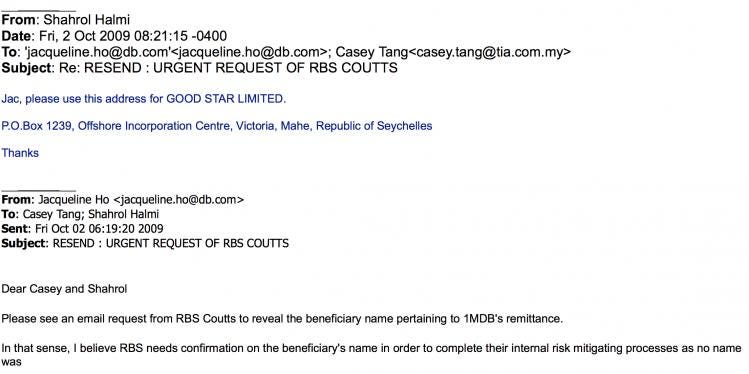

Shahrol

Halmi also knew full well that the money was being ‘paid back’ not to

PetroSaudi but to Good Star, as his emails make plain. If he had checked

the beneficial ownership of Good Star he would have realised it

belonged to Jho Low and that the company was not part of the ownership

structure of PetroSaudi.

Mr

Arul Kanda is of course welcome to say that these documents, which are

also in the hands of international regulators and other news

organisations have been ‘doctored’ and ‘tampered’ by Sarawak Report.

He

should take us to court and compare his copies with ours and explain

why it is that all the surrounding evidence about the 1MDB PetroSaudi

affair ties in nicely with our allegations, while for his part he cannot

stick to the same answer two days running.

Malay Version of the Bank Negara Letter of Permission:

Page 2

English translation:

Confidential

BANK NEGARA MALAYSIA CENTRAL BANK OF MALAYSIA

29 September 2009

Mr

Tang Keng Chee

Executive Director

1Malaysia Development Berhad

(848230V)

Level 8, Menara IMC,

No.8, Jalan Sultan Ismail,

50250 Kuala

Lumpur.

Sir,

OFF-SHORE INVESTMENT

We refer to the 1Malaysia Development Berhad application (1MDB).

2. Permission

is given to 1MDB to remit funds in the sum of USD1 billion for the

purpose of obtaining 40% shareholding in 1MDB Petrosaudi Limited,

British Virgin Islands (PetroJV). The reference number of the said

investment is IO95174.

3. For the purpose of simplifying the statistical compilation of the balance payments by the Central Bank of Malaysia-

(a)

1MDB has to disclose the information required by the local licensed

bank (commercial bank, Islamic bank or local investment bank) for

convenience in remitting the investment funds which is in excess of RM

200, 000 on behalf of 1MDB; and

(b)

The Malaysian Central Bank’s Department of Statistics will contact 1MDB

with regard to a quarterly report in respect of 1MDB’s assets and

liabilities to be submitted to the Central Bank of Malaysia.

4. We take note that:

(a)

PetroJV is a joint venture company held 40:60 by 1MDB and its joint

venture partner, Petrosaudi Holdings (Cayman) Ltd, Cayman Islands;

(b)

PetroJV will utilize the equity funds totaling USD 2.5 billion from its

shareholders to fund the investment in the energy, agriculture, real

estate and tourism sectors in Malaysia and overseas;

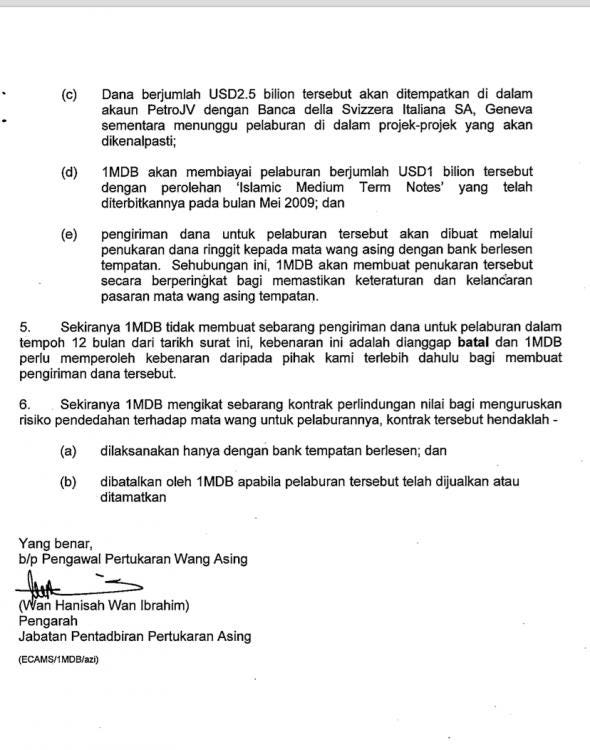

(c)

The said funds in the sum of USD 2.5 billion will be placed in

PetroJV’s account with Banca della Svizzera Italiana SA, Geneva pending

investments in future projects;

(d)

1MDB will fund the investment in the sum of USD 1 billion with the

acquisition of “Islamic Medium Term Notes” which were issued in May

2009; and

(e)

The remittance of such funds for the said investment will be done via a

foreign exchange of the funds in Ringgit to the relevant foreign

currency with a local licensed bank. In this connection, 1MDB will make

the exchanges in stages to ensure order and smoothness in the local

foreign currency market.

5. In

the event that 1MDB does not make any remittance of funds for its

investment in the period of 12 months from the date of this letter, this

approval will be rendered cancelled and 1MDB would be required to obtain permission from us prior to the remittance of such funds.

6. In

the event that 1MDB is bound by any value protection contract to manage

currency exposure risks for its investments, the contract has to be:-

(a) executed with a local licensed bank; and

(b) terminated by 1MDB when the said investment is sold or has come to

an end.

Yours faithfully,

On behalf of Foreign Exchange Officer

(Wan Hanisah Wan Ibrahim)

Director Foreign Exchange Administration

Originally published at www.sarawakreport.org.

Sarawak Report

The official home of Sarawak Report on Medium

1 comment:

Grateful ffor sharing this

Post a Comment